Trading Triangles and How They Work

As a price action trader, I tend to love particular price patterns. For decades and decades, technical traders have been using chart patterns as an approach to forecast, or to create favourable risk/reward trading opportunities.

So what makes particular chart patterns appeal to technical traders? Simply, these patterns define the rules in which a trader can implement in trading each particular pattern. See, the thing is as patterns form, we get an inkling of what to expect from the market if the pattern plays out. We also know how to easily define our risk. What trading price patterns does is give us some parameters and boundaries in a completely random market.

Defining a Triangle Pattern

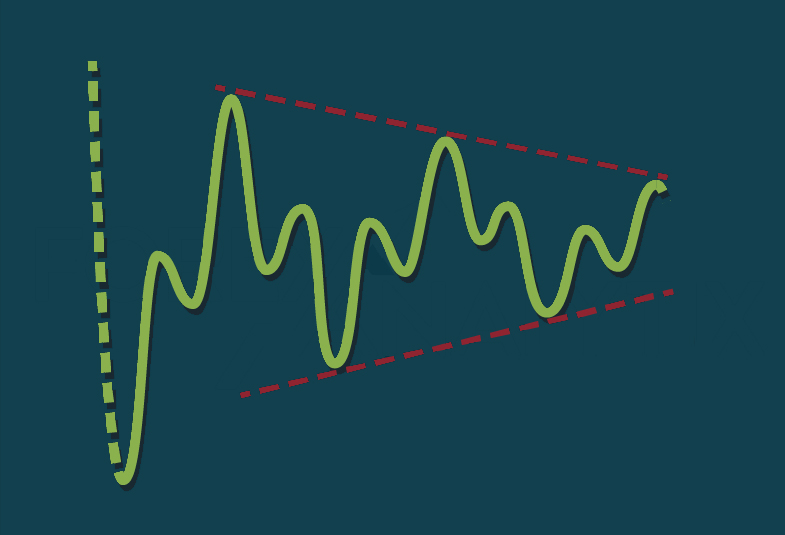

What we’re looking for with any triangle pattern is a contraction. Basically, two lines that tight up from start wide apart and as price contracts to the right the two lines get closer together, converging. This is an indication the price is coiling, building up energy for its next move.

Consider the diagram below.

As mentioned you can see price contracting in waves toward the apex of the triangle shape. And as you can likely guess, we’re looking for price to break through one of the triangle’s edges and take the trade accordingly.

Contracting triangles form not just in the Forex market, but in every financial market. As is generally the case with most popular trading patterns, the longer the timeframe of the chart in which they form, typically the more reliable the pattern tends to be in terms of its likelihood of playing out.

You’ll notice that before most significant news events that the price action of affected instruments tend to display a contracting triangle of some form in the lead up prior to the announcement. Given the volume of news releases that can affect a variety of instruments you could almost say that the forex market is in a form of consolidation period for the majority of the time, coiling during the build up to these announcements before launching in a particular direction, depending on the positivity or negativity of the news that’s affecting it.

As forex traders, we know that good rules define a good system. And if a pattern has rules to follow, in the long run, profit will prevail. When integrating triangles into your trading system, with clearly defined stop and profit levels, contracting triangles, whether ascending, descending or symmetrical triangles are some of the most powerful patterns to include in anyone’s forex trading system.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account