Analysing Chart Patterns: Double Top & Double Bottom

Today we’re going to chat about the popular Forex market reversal patterns, double tops and double bottoms. In its simplest terms these patterns are significant because they indicate price has stopped rallying in a particular direction.

Double Tops

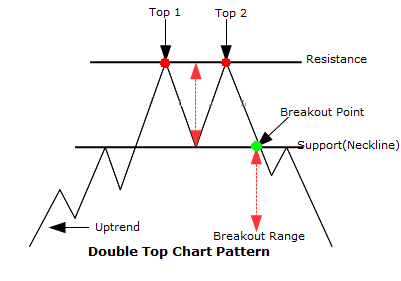

Double tops tend to form when price reaches a high within a current uptrend, and then pulls back. It rallies again to the previous high area before stalling and pulling back, falling below the low of the previous pullback. The reason it’s called a double top is because price peaked at the same area twice and was unable to reach new highs, above previous resistance.

Once this popular reversal pattern is confirmed or complete, traders can place a short trade, or exit their long positions, of course, once price drops below the previous swing low.

Target Areas

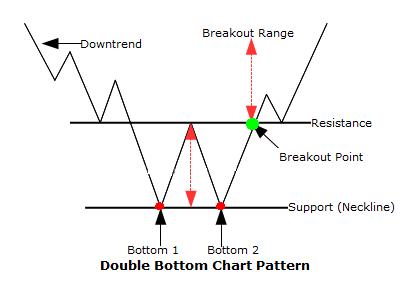

When determining a potential profit target area, we use the height of the pattern, minus the breakout price point. The time it takes for price to reach a target area can vary significantly, and as suggested by our measured move target areas, smaller patterns will offer smaller targets & vice-versa.

Double Bottoms

A double bottom forms when the price of an instrument makes a low within a downtrending market, pulls back to the upside, and on the next decline stalls near the prior low area before rallying above the previous swing high.

Trading Considerations

It’s important to note that not all traders trade forex chart patterns, however you might want to consider using it as an exit signal should one occur in the opposite direction in which you’re trading.

Also, target areas may not be reached, or price may surpass them. All our stop and target areas do is determine a RR ratio, based on the physical character of the pattern. With double top and bottom patterns, the risk tends to be quite close to the reward which isn’t particularly ideal for many traders in comparison to some other patterns, such as the cup & handle. It’s a nice idea to use your discretion when trading double top and bottom patterns, and try to only take those that offer an attractive RR ratio.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account

About us

Vantage is a global, multi-asset broker offering clients access to a nimble and powerful service for trading CFDs on Forex, Commodities, Indices, Shares, and Cryptocurrencies.

With more than 10 years of market experience and headquartered in Sydney, Vantage now has over 1,000 staff across more than 30 global offices.

Vantage is more than a broker. It provides a trusted trading ecosystem that enables clients to achieve their own success, in a faster and simpler manner.

Be empowered to better capitalise on winning market opportunities when you trade smarter @vantage.

Contact us

+44 2080 363 883

71 Fort Street, 3rd Floor, George Town, Grand Cayman, Cayman Islands, KY1-1111.

Registration Number: 323723

Vantage is a trading name of Vantage International Group Limited trading under Vantage, is authorised and regulated by the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491 and is registered at Artemis House, 67 Fort St, PO Box 2775, Grand Cayman KY1-1111.

Risk Warning: Trading derivatives carries significant risks. It is not suitable for all investors, and if you are a professional client, you could lose substantially more than your initial investment. When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets. Past performance is no indication of future performance, and tax laws are subject to change. The information on this website is general and doesn't consider your personal objectives, financial circumstances, or needs. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you, considering your objectives, financial situation, and needs. We encourage you to seek independent advice if necessary. Please read our legal documents and ensure you fully understand the risks before making any trading decisions.

The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

While the Authority has granted a securities or derivatives investment business licence to the Licensee, the Authority does not endorse or vouch for the merits of the products offered by the Licensee.

Copyright © 2024 Vantage. All rights reserved.