Analysing Chart Patterns: Cup and Handle

Following on from our recent Head and Shoulders article, we’re now going to go over one of my personal favourite patterns, the Cup and Handle pattern. Acting as both a continuation and reversal pattern, it can mark the end of a downtrend as well as price pausing before resuming an uptrend.

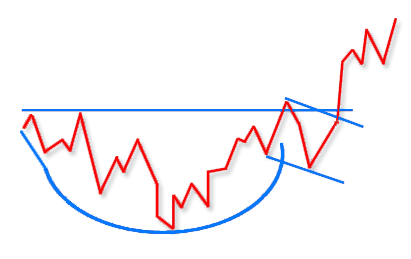

Cup and Handle patterns are similar to that of a rounded bottom pattern, with the exception that the cup pauses near the breakout point and moves sideways for a short time. Consequently, this consolidation period constructs the ‘handle’ of the pattern.

Cup and Handle Reversal Pattern

For a Cup and Handle reversal forex pattern to take shape, the price of an instrument must be falling, or bearish. As we start to see downward momentum slow down, price begins to consolidate in the form of a round bottom, as it begins to rise. This is what we call the ‘Cup’. Now that we have the cup price must consolidate briefly either sideways or slightly lower to form the ‘Handle’.

The Handle part of the pattern more often than not retraces or consolidates within a channel, and to maintain a valid pattern setup the Handle mustn’t retrace more than 40-50% of the Cup height. Should price move down past our 40-50% levels, we can assume that there is too much selling interest and an immediate reversal is less likely.

Due to the handle often taking form within a channel, traders could take a position as price moves out of the channel, placing their stop loss just underneath the low of the handle. This provides a very attractive risk/reward trade.

When estimating potential target areas, or establishing your RR for the trade, we can use the height from the base of the cup to where the handle breaks out. This measured move assumes that the equivalent of at least the height of the cup will be reached on the next leg up in price. If, as a confirmed Cup and Handle pattern suggests, the longer-term trend has reversed, price should reach, and even exceed this target area.

Cup and Handle Continuation Pattern

When a Cup and Handle occurs within an uptrend, it’s very similar to the reversal setup. As such, price is moving higher and then retraces to form the Cup and Handle, before breaking through the handle to signal the continuation of an uptrend.

Just like the reversal Cup and Handle pattern, traders can enter on a break of the upper trendline of the handle, placing a stop loss under the handle’s low and the profit area approximately the depth of the cup in height above the breakout area.

Cup and Handle patterns are one of my favourite Forex patterns because of a couple of things: Price is already in an established uptrend, and the pattern is showing that price is starting to rise again following a pullback. With momentum on its side, this tends to be quite a reliable pattern, especially the continuation Cup and Handle.

The risk reward on both reversal and continuation Cup and Handle patterns makes the pattern a very attractive setup.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account