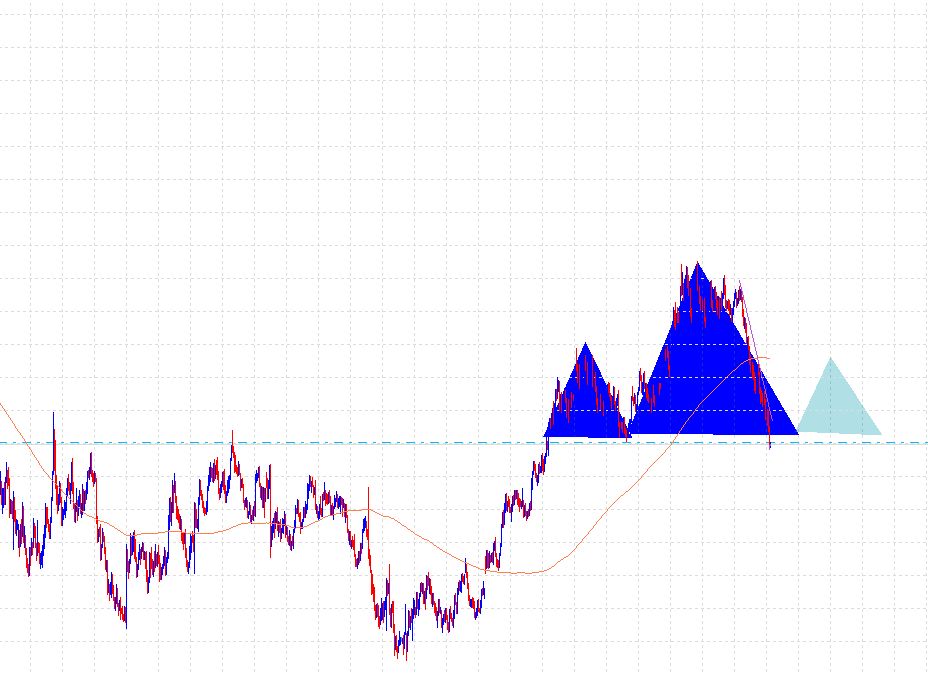

Analysing Chart Patterns: Head and Shoulders

As technical forex traders, we use the price history of a given instrument, and the particular shapes and patterns that occur as our basis for not only taking a trade, but determining our risk and profit areas too. While the …

NZDUSD range bound for now, but is it winding up for a big move?

Happy Monday, traders. Today were going to have a look at the NZDUSD weekly chart. We can see that for close to 2 years price has been ranging in between our areas of support and resistance, or you could say …

Trading Lessons from the Market Wizards

For novices and professionals trading the forex market, there are a couple of must-read books. And right near the very top of the list is Jack Schwager’s, The New Market Wizards. The book itself contains so many trading gems from …

A Few Little Tips & Tricks To Get More From MT4

If you’re a forex trader you’ll know that MetaTrader 4 is the king of Forex trading platforms. Not only does it allow you to place and manage orders, undertake various technical analysis functions and auto trade, it also allows you …

Thinking in Risk and R-Multiples and Forex Trading

Thinking in Risk and R-Multiples When thinking about risk, it’s fair to say that it can be defined by the amount of money that you’re willing to lose if you’re wrong about the market. Or, more specifically how much per …

Is the NASDAQ winding up for a move?

Good afternoon, Traders. A quick post to bring to attention what’s happening in the US indexes, specifically the NASDAQ. At a glance the chart looks to be tightening up and could be getting set for a move. Looking at the …

The closest thing to a Forex trader’s bible – Trading in The Zone

In the trading world, there are a few reads that are a must, regardless of what instrument you trade. While Jesse Livermore’s Reminisces of a Stock Operator is often the first that comes to mind (and for good reason), the …

USDSGD Bounce or break?

Happy Monday, Traders! One of the first things i stumbled into this morning was a potential setup on the USDSGD pair. After a lengthy downtrend we’ve seeing price stall/consolidate for a couple of months now. Consider the daily chart below. …

The biggest mistake new Forex traders make

This is quite a long overdue post but today I want to address one of the biggest and most common trading mistakes newbies and experienced traders alike can make: Trading with too large volume. I’m going to break this down …

What’s the Difference Between Balance Volume vs Accumulation/Distribution

The on-balance volume (OBV) and accumulation/distribution indicators found on MT4, and many other platforms are quite similar in the sense that they’re both momentum indicators that aim to predict the flow of ‘smart money’ using volume. This however, is where …

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account