Overnight Headlines

*USD makes new cycle highs, risk rout pauses

*US equities tumbled on Delta worries, futures in the green

*Vix hits 25, bond yields collapse to the lowest level in six months

USD rose sharply along with traditional safe haven currencies like JPY and CHF as reflation took a beating and fixed income assets rallied hard. On the flip side, NZD, CAD and AUD were the biggest underperformers with the kiwi and aussie touching levels not seen since November last year. Cable hit five-month lows and is trading on its 200-day SMA as Americans were told not to visit the UK on England’s supposed “Freedom Day.”

US equities were under pressure yesterday with the S&P500 closing 1.6% lower and the Nasdaq fell 1.1%. European bourses were hammered, with the FTSE100 and Stoxx Europe 600 both tumbling 2.3%. Asian markets are down roughly 1% but futures for European and US markets point to a pause in the panic and a more stable opening.

Market Thoughts – Covid fears return

“Summer months always throw up challenging market conditions so the pandemic should really just add to the mix of thin liquidity and unpredictability. Less activity and less risk taking means more volatility.” We started yesterday’s thoughts with this and it will probably be fitting throughout the next few weeks. Traders, or the ones who are at their desks, are faced with thin markets across the summer months. This means moves will be exaggerated and sometimes tough to understand.

New outbreaks of the virus hitting global growth are the biggest worry currently. Teetering recovering economies are on the back foot even more, so the trend in dollar strength continues. Any slowing in reopening will probably result in tapering being delayed. Is this a buying opportunity in stocks? The issue with this is summer liquidity could leave us scratching our heads until more usual market conditions return.

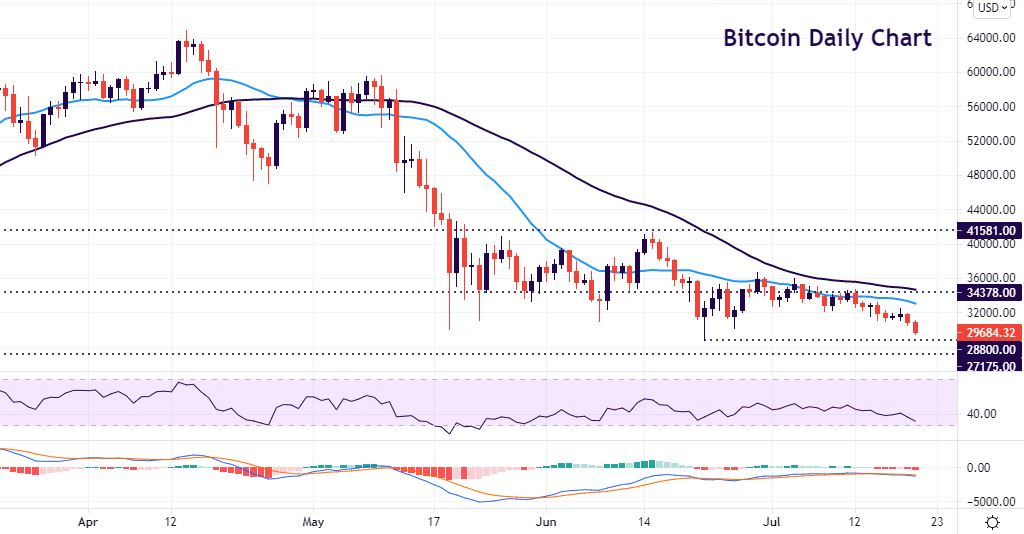

Chart of the Day – Bitcoin below $30,000

Bitcoin is trading below $30,000 for the first time in almost a month and looks to be rolling over. Bears are endeavouring to establish another leg lower amid the recent series of lower highs and lower lows. The breakdown through the psychological $30,000 level may see more sellers jump on board as the bearish momentum picks up. First support lies at the $28,800 June low. The 38.2% Fibonacci level sits below here around $27,175 which could come quickly. Bulls need to push above $32,450 and ultimately $34,378 to slow the downside.

Jamie DuttaAnalyst / Trader

"With extensive experience as a full time trader and financial market commentator, I have worked as a trader in top tier investment banks and trading houses, including Morgan Stanley and GAIN Capital trading Forex, Index derivatives. and Bonds. I combine technical analysis with a deep fundamental knowledge to identify trade set-ups. My real life experience allows me to break down the complexities of financial jargon and trading. This means everyone can better understand the compelling forces of greed and fear which are realised every day in countless ways across markets."

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account