Overnight Headlines

*USD reclaimed initial losses closing higher at 92.82

*US equities notched their best three-day advance since April

*Twitter posted a strong outlook while Intel guided lower on margins

*UK retail sales beat expectations (0.5% v -0.1% m/m)

USD gyrated across Thursday before closing marginally higher. DXY dipped under trendline support from June before a dovish ECB saw buyers step in. EUR erased gains to 1.1830 and closed near its lows. It looks like it’s only a matter of time before we touch the cycle low at 1.1704. GBP outperformed among the majors with cable up for a second straight day. The UK government is rolling out daily coronavirus testing for critical workers amid the “pingdemic”.

US equities led by tech and healthcare stocks pushed higher to the brink of another record close. It was a quieter day than previous days in the week dominated by stronger than expected Q2 earnings. All eyes are on big tech next week including Facebook, Apple, Amazon, Alphabet and Tesla. Futures are pointing to a stronger open in Europe despite Asian indices ending the day lower.

Market Thoughts – ECB dovish as expected

The ECB settled on a more dovish message which reflected the newly revised strategy. This underlines its commitment to maintain a “lower for longer” accommodative policy stance to meet its inflation target. This may also lead to a delayed tapering and even more QE beyond March 2022.

These decisions were not unanimous with the battle between the hawks and the doves noticeable. This means we should expect more comments on the wires with the dissenters disagreeing with the calibration of the change in forward guidance. This now sets out tougher criteria that need to be met for rate hikes and most definitely puts the hawks in a tough spot.

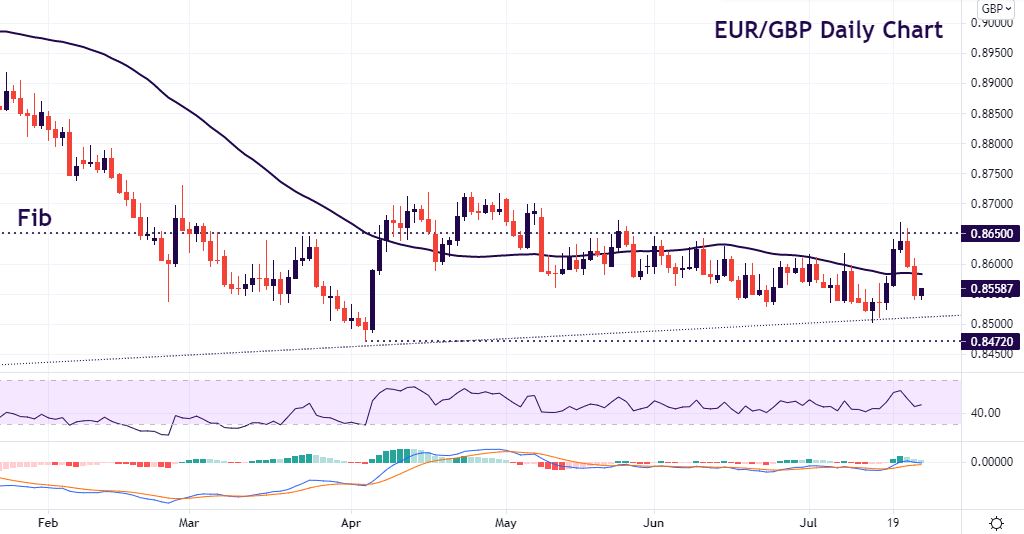

Chart of the Day – EUR/GBP back in the range

In line with a broader improvement in sentiment, GBP has rebounded over the past few sessions. The post-Brexit rift between the UK and EU has had limited impact so far. The mass isolation experiment in the UK regarding “freedom day” is the outlier with many aghast at the potential for new lockdowns and their economic impact.

EUR/GBP has returned to its sideways range that had held for over two months. Prices pushed up through 0.8650, a Fib level of the December to April move. But the failure to close above here means we are back aiming for the 0.8472 low, though that is a very tough level to crack. There is also long-term trendline support just above 0.85 to contend with too.

Jamie DuttaAnalyst / Trader

"With extensive experience as a full time trader and financial market commentator, I have worked as a trader in top tier investment banks and trading houses, including Morgan Stanley and GAIN Capital trading Forex, Index derivatives. and Bonds. I combine technical analysis with a deep fundamental knowledge to identify trade set-ups. My real life experience allows me to break down the complexities of financial jargon and trading. This means everyone can better understand the compelling forces of greed and fear which are realised every day in countless ways across markets."

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account