Overnight Headlines

*USD near one-month highs after choppy FOMC session

*US stocks rallied on easing Evergrande concerns

*The Vix dropped close to 20 as market jitters reduced

USD was choppy with an initial selloff after the Fed statement reversing course during Chair Powell’s press conference. More hawkish signs of when tapering will be announced and potentially finished saw a bid in USD. It made a high of 93.51 and closed on support/resistance at 93.43. EUR saw a high of 1.1756 before a low of 1.1685 and closing near 1.17. GBP edged towards August lows at 1.3602 before bouncing. JPY saw a little downside on the BoJ meeting before moving back towards 110.

US equities rebounded with the main indices all up +1% or so and the small caps Russell 2000 +1.5%. The Dow snapped a four-day losing streak. The S&P500 posted its first positive session in five. A 3.2% jump in the energy sector helped, with banks and tech also outperforming. Asian shares are gaining as Evergrande looks to have “resolved” a coupon payment. Beijing is also working on a plan to take over the company. US futures are solidly in the green.

Market Thoughts – More hawkish Fed than presumed

The bottom line from last night’s FOMC meeting – a taper will arrive in November and potentially be finished by June next year. On this timeline, the Fed will start tapering at $15 billion per meeting (or $10 billion per month) and may accelerate it towards the end. This assumes a “decent” employment report next month and not even a “knock-out” one, Powell said.

This message is more explicit and more aggressive than many expected. The median forecast for the first hike has been brought forward to 2022. The 2023 median is now at 1% versus 0.6% in July. Only one member doesn’t expect a hike by the end of 2023, a huge change from just six months ago. The policy rate for 2024 comes in 1.8% which is well ahead of market expectations.

The initial dollar selloff may be due to profit taking and more optimism around the Evergrande picture. But the hawkish shift means the market will be more sensitive to strong data. The greenback really looks to be a buy on dips story.

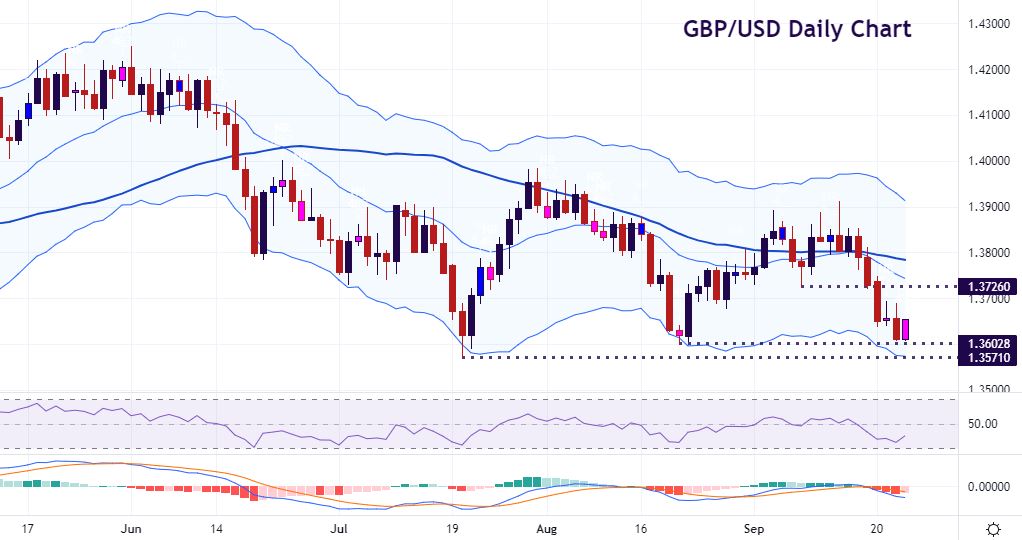

Chart of the Day – GBP/USD holding support for now

The BoE will keep policy on hold at its interim meeting today. High recent CPI has garnered the headlines and bolstered some hawkish analysts. But the bank’s most recent inflation forecasts suggest there is no need to act quickly. Forward guidance has only just been updated and there are no new forecasts today. The transition out of the furlough programme will add uncertainty, plus fiscal policy turns into a headwind.

EUR/GBP may push higher if hawkish hints are not met. The September high at 0.8613 beckons which is similar to cable support around 1.3602. If dollar bids do come in as well, further GBP falls to the bottom of the recent trading channel look odds-on. Resistance above sits at 1.3725 if a more upbeat message is seen from the Old Lady.

Jamie DuttaAnalyst / Trader

"With extensive experience as a full time trader and financial market commentator, I have worked as a trader in top tier investment banks and trading houses, including Morgan Stanley and GAIN Capital trading Forex, Index derivatives. and Bonds. I combine technical analysis with a deep fundamental knowledge to identify trade set-ups. My real life experience allows me to break down the complexities of financial jargon and trading. This means everyone can better understand the compelling forces of greed and fear which are realised every day in countless ways across markets."

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account