Overnight Headlines

*US stocks fell after September NFP missed estimates

*USD slipped against most of its G10 peers, DXY still above 94

*WTI oil topped $80 for the first time since November 2014

*BoE officials double down on signals of imminent rate hike

US equities dipped lower on Friday driven by the mixed US employment report. Interestingly, the inflation/stagflation trade continued with energy and financials outperforming. This points to the (demand/supply) imbalances in the jobs data being more pronounced that many think. Asian markets are split with Hong Kong and China tech sharply higher. US and European futures are marginally lower this morning.

USD was relatively quiet on the disappointing headline NFP print. The revisions and falling unemployment figures meant most still expect the Fed to start tapering next month. CAD led the charge, rising 0.6% buoyed by higher oil prices and a positive domestic jobs report. GBP is the strongest major this morning as two BoE officials sounded concerned about higher inflation and warn of interest rate hikes happening soon. Cable looks to be on its way to 1.37. USD/JPY is following bond yields higher, jumping to its highest levels since December 2018.

Market Thoughts – Post N.F.P

While the headline rose just 194k (consensus saw a gain of 500k), tapering is still expected to go ahead. The past two months were revised higher by a total of 169k. In fact, 13 of the last 16 payrolls figures have been revised. This really shows how Covid-19 has messed up seasonal dynamics.

Areas of concern for the Fed were wage growth that was much higher than expected. Also, the labour force shrank causing the unemployment rate to fall below 5%. These will both add to stagflation concerns (slowing growth amid faster inflation). The competition for workers is intense and will push up wages and increase inflation pressures.

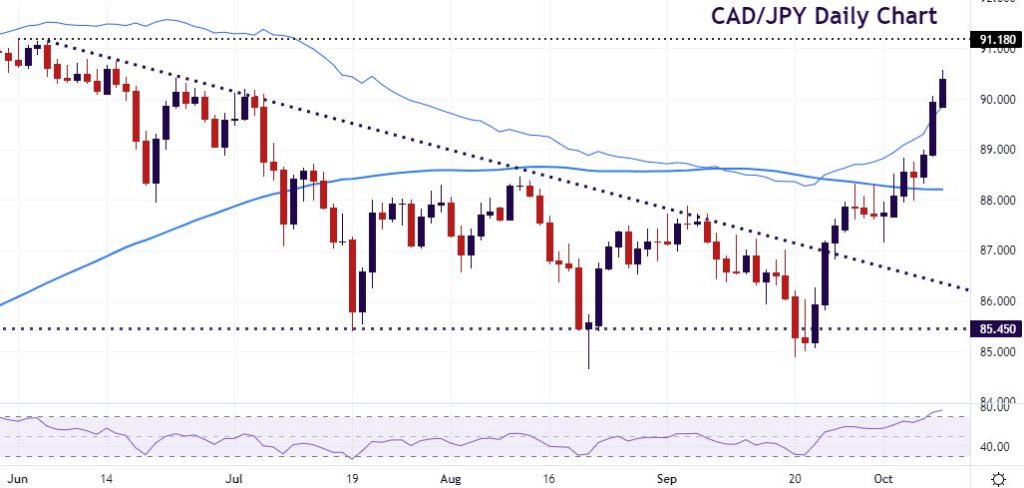

Chart of the Day – CAD/JPY shoots higher

The loonie enjoyed a bumper jobs report on Friday. The economy posted a monster jobs gain in September (157k v 65k expected) pushing employment back to its pre-pandemic levels and the jobless rate hit an 18-month low. Analysts said while the headline print seals the deal for another taper from the BoC later this month, there’s still a way to go to fully heal the labour market. Strong oil prices are also giving a bid to CAD.

The safe haven yen is seeing selling to kick off the week. This has reinforced the push higher in CAD/JPY. After hovering above 88 and around the 100-day SMA, buyers have driven prices to levels last seen in June. The year-to-date high comes in at 91.18. But the pair very overbought on the daily RSI and through the upper Keltner channel. Support is at a Fib level at 89.78 and then 88.69.

Jamie DuttaAnalyst / Trader

"With extensive experience as a full time trader and financial market commentator, I have worked as a trader in top tier investment banks and trading houses, including Morgan Stanley and GAIN Capital trading Forex, Index derivatives. and Bonds. I combine technical analysis with a deep fundamental knowledge to identify trade set-ups. My real life experience allows me to break down the complexities of financial jargon and trading. This means everyone can better understand the compelling forces of greed and fear which are realised every day in countless ways across markets."

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account