What Makes a Breakout a Breakout?

As suggested by the term, a breakout is when price breaks out of a defined area of support or resistance, a trendline, or a price pattern.

Simple as that, right? Well, you’d be surprised how often traders get this wrong.

Today, I’m going to go through how I like to define a confirmed breakout, and take you through a couple of different ways that breakouts can be traded.

So, without further delay, let’s get cracking.

Defining the term ‘breakout’

Put simply, a breakout is the point at which price moves out of a key support or resistance area, a trendline, or a price pattern.

As price action traders, these breakouts make up a HUGE component of our strategy as well helping us to determine, through offering attractive Risk/Reward setups, where the market could go next.

Why timeframe matters

As a trader, one of your biggest enemies is noise. Anything from politics, to interest rates, NFP, etc can whip price around causing short term volatility and potentially shake you out of a trade.

Sure, there’s a lot of profit to be made trading these short term catalysts, but I tend to consider it nothing more than noise.

So, what’s noise? When I use the term noise I’m referring to short term choppiness and volatility that doesn’t really have an impact on the longer term trend. They key to not letting noise shake you out or get you into a Forex trade that’s perhaps a lesser probability is to simply zoom your chart out, and switch to a decent timeframe, like h4 or up. When you do this, event driven volatility looks inconsequential to the bigger picture, and it also allows you to see more significant breakout areas or potential zones of support and resistance.

Using the daily close of a candle as confirmation of a breakout will almost nullify the effect of the volatility caused by news events, as all too often after a volatile move on news, price tends to retrace quite often, causing a false breakout. That’s why when it comes to breakouts, it’s the daily close that matters, nothing else.

To wait, or not to wait. That is the question.

Ok, so now you know that by using a daily close as confirmation of your breakout you can avoid whippy noise.

Now let’s discuss whether you should trade the breakout, or wait for a retest of the breakout level.

Quite frankly, there’s no real right or wrong answer to this question. Each trader needs to do what works best for them.

But for those interested in retests, there are a couple of things that you can consider that may prove valuable to your trading strategy.

Quantifying a retest

You’re likely familiar with price retracing back to your horizontal break out level, so we’ll skip that one for now. But how familiar are you with mean reversion? Simply put, as the name implies, this is the assumption that price will eventually come back to its average price over a given time period.

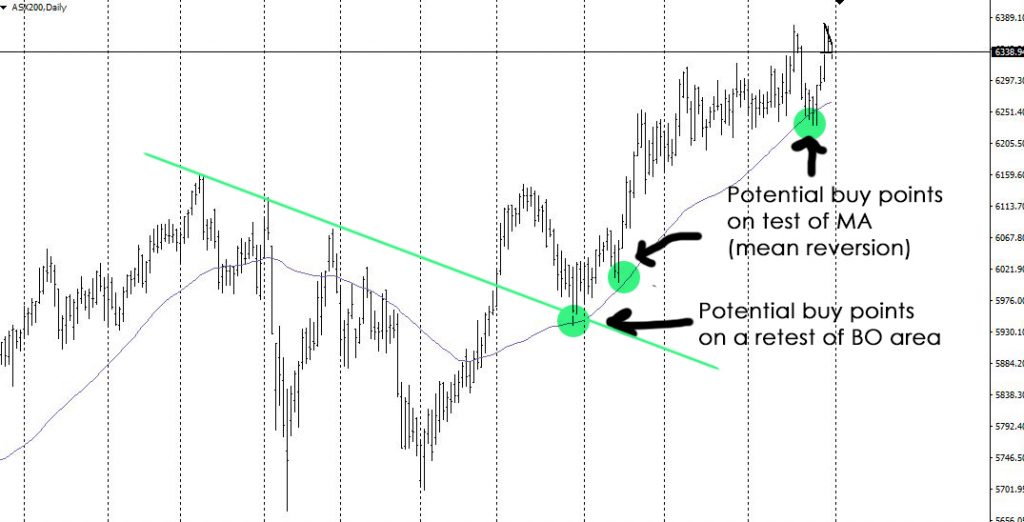

Consider the daily ASX200 chart below.

Ok, so you can see that price broke out of our downward trend line, before retracing and testing the breakout area. In this particular case, the retest also coincided with our 50 day MA. I’ve got to say, nothing makes me happier than when confluence like this occurs. Although in hindsight, this would have offered a valid entry signal from the retest of our trendline and the 50 day MA. As price grinds higher, we see a couple of additional entry points that you could have added to your position on. Each time price offered a shallow retracement to our 50 day (mean reversion), and then resumed its upward trend.

You can see in the above example the benefit of waiting for the retest, although it doesn’t always look as good as that. All too often price won’t return to the BO area, but alas, there will always be another trade for those who prefer to use the retest as an entry signal.

To wrap it up

While it’s easy enough to spot a breakout in the Forex market, it requires discipline and patience in ensuring that you wait for the daily close as confirmation, otherwise you risk getting caught in a false movement.

If you’re struggling with patience, I’d suggest only looking at your trading platform once a day, at the time when a new daily candle is formed. Sometimes a little distance can work wonders in allowing a strategy to prove itself to you.

Until next time, traders.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account