Using MAs as Dynamic Support and Resistance

For those who use price action to trade the Forex market, there’s a mixed opinion about the use of moving averages. I mean, why would you use them if price is your indicator?

Well, let me explain why MAs can add a lot to any trader’s toolkit. We’ll go over which ones I like to use and why, and also what to look for.

First, what’s a Moving Average?

A moving average, or MA, is pretty much just a smoothed indicator of price over a given period. While there are several different types of MAs, the two most common and basic are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

SMAs and EMAs typically act the same way, though EMAs place a little more weight to more recent prices, although they both represent the previous price action for a specific period of time. As an example, the 100 period SMA on a daily chart would use the 100 previous days of price action to display the average price of that period.

So, the 100 period SMA is on the daily chart, so it represents the past 100 days. If this was on a 1 minute chart, it would represent the past 100 minutes.

Now, what divides price action traders when it comes to MAs, is that they are a lagging indicator. That means that they are based on the past and not the present. But that’s not always a bad thing as we’ll discuss.

Which Moving Averages Are Best?

Let me preface, there is no ‘right’ way to use an MA, and those who use them have their own preference. Me, personally, I quite like the 200 day SMA. It functions perfectly as a filter for directional bias. Ie, if price is above the 200 SMA, only take long trades, and vice-versa for shorts.

How to Use MAs

As briefly touched on above, moving averages are typically used in one of two basic ways:

– To identify a change in trend or the strength of a trend.

– As dynamic levels of support and resistance.

Trends

MAs can provide insight to possible trend changes as well as showing traders an indication of the strength of an existing trend. Using an MA to determine the trend of an instrument is great… during trending moments, but during consolidation periods, relying on MAs all-too-often causes traders to get whipped out of trades. When determining the trend of a market by using MAs, as mentioned above, I prefer to use a single 200ma. However, quite a popular method used widely by Forex traders is the crossing of two different MAs – on a shorter and the second a longer duration. The example below shows the bullish and bearish crosses of a 50 SMA & 100 SMA.

The methods of trading this, or a similar setup depends very much on the trader, but whilst not a perfect system, you can readily identify the changes in trend, whether brief or sustained.

Dynamic Support & Resistance

Now, we’re all familiar with using horizontal or diagonal lines as indicators of support & resistance levels. But let’s chat about how MAs can be used for dynamic support & resistance.

Before we go into dynamic S&R, I’m of the strong opinion that it isn’t as strong or reliable as horizontal S&R levels, however they do still have their uses.

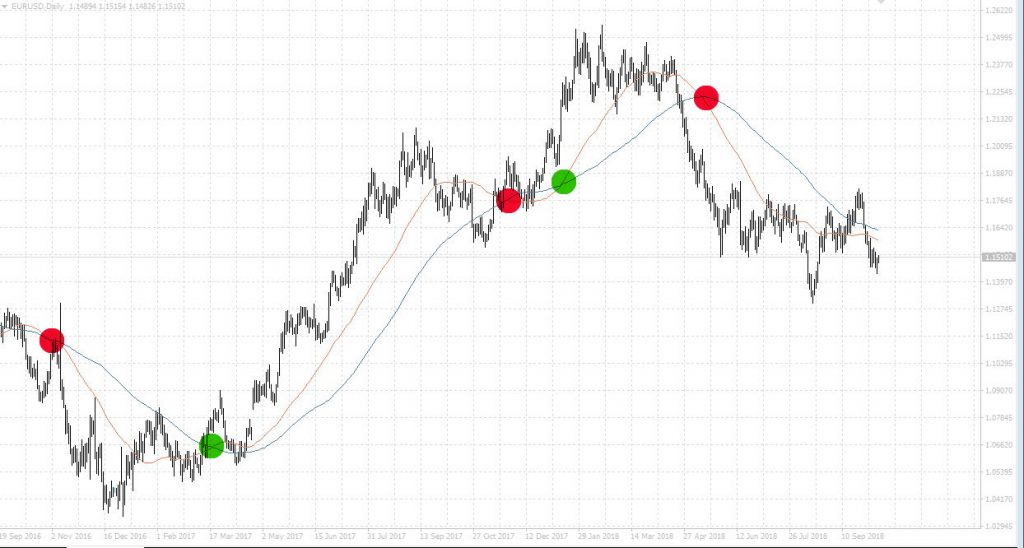

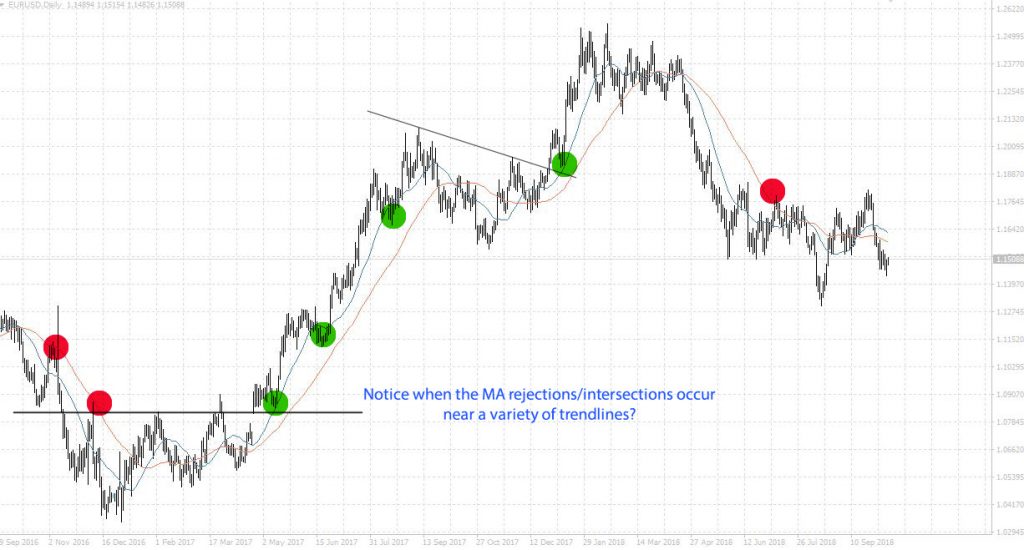

Simply put, dynamic support & resistance can be established or found when price rejects or intersects with a particular moving average.

You’ll notice how the 20 & 50 period MAs act as support and resistance as price moves in a particular direction. These become valuable aids, whether adding to positions, or using as additional confluence with trend lines as per the example below.

Now of course you can break this down even further and look for specific candle patterns that indicate the rejection of an MA, but that’s another post all together.

So Why Does Dynamic Support & Resistance Work?

The reasons why MAs work as dynamic support & resistance is no different to the reasons that price action works… because so many traders use moving averages there tend to be noticeable patterns that form.

You see, the thing about when a significant portion of traders use certain key MAs as support & resistance, etc, then price tends to respect it. Almost like it’s self-fulfilling (or herd-fulfilling).

As per usual with the Forex trading, there are no guarantees. These moving averages are simply another tool that can be used.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account