Trading Breakouts vs. Retests. Which is better?

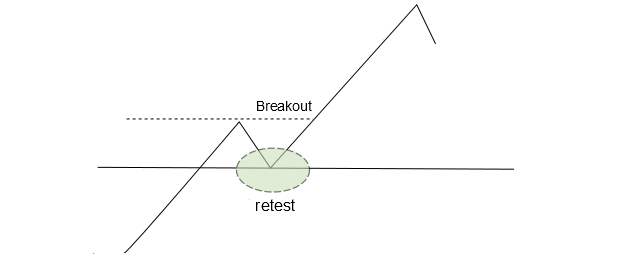

As a technical trader, one of the common topics of discussion is around whether a trade should be taken immediately as price breaks out of our zone, or should we wait for it to retrace to the breakout level?

There’s no simple answer to this question, but today we’re going to cover a few important factors to consider when deciding whether to trade the breakout, or the retrace.

As with all things related to trading the Forex market, there are never any guarantees or fail safe setups. The market does what it wants regardless of our level of confidence or conviction.

But when developing your strategy there are a couple of considerations that should be known. For instance, there’s never a guarantee that once price has broken out that it will ever return to that level. So, if you’re waiting for it to retrace, you could possibly be waiting a VERY long time while the market has taken off leaving you behind.

So what’s your style?

This is a super-significant question to consider when deciding to trade breakouts vs. retests. Sadly, it’s also very often overlooked.

While many new traders spend a lot of time searching for the Holy Grail, or magic trading formula without putting any time or effort into thinking about the specific trading style that suits their goals, lifestyle, and personality.

It’s no secret that what works for one person doesn’t necessarily work for another, so when starting out you have to experiment with different methods. And while a strategy may be quite profitable, it doesn’t mean that you can profit from it as it may not suit your personality.

So what’s this got to do with deciding to trade the break or wait for a retrace? Everything. Some traders are more aggressive than others, while others are more conservative. Trading the retrace means you’ll have to be ok with missing out on some trade opportunities simply because price doesn’t come back and test the breakout level. Breakout traders may get whipped around a bit, and depending on when they got into their position, need to be comfortable with the market pulling back to their entry price every so often.

Why do I keep banging on about Risk Reward?

I know I sound like a dripping tap, but you must ONLY take trade setups that have a favourable R:R ratio.

So what’s considered favourable?

While this is quite subjective, I always look for the potential reward to be at least twice the size of the risk, or 2R (read more about thinking in R multiples here).

Often, when this is the case, trading the breakout simply can’t be done because the trade doesn’t adhere to my 2R expectations, in which case the retrace is perfectly suited to the 2R expectations of my trade.

Getting to know your currency pairs

Finally, which currency pair you’re trading. For instance, some pairs trend better than others, while some a prone to more choppiness and volatility.

That’s why it’s important to note how the previous price action of the pair you’re trading has acted of the previous weeks/months of action.

Wrapping up

There’s no shortage of factors that influence whether you should trade the breakout or wait for the market to retest the breakout zone, but far and away the most important factor is your trading style.

Also, don’t forget that an attractive R:R ratio should never be compromised, because without a solid ratio there is no setup.

At the end of the day, all types of forex trading are about finding what works best for you. So put the effort in to finding a method that fits your lifestyle and personality.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account