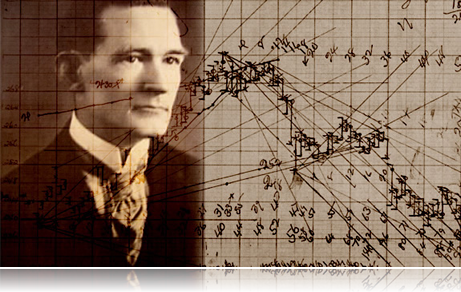

The World According to WD Gann

Anyone in the Forex trading world should be at somewhat familiar with the name Gann. William Delbert Gann, or WD Gann was a trader who developed a technical toolset called ‘Gann Lines and Angles. While Gann angles hold great significance to many traders out there, that’s not what today’s blog is about. As impressive as they were, even more so are the rules he traded by, which is what we’re about to get into.

Gann’s Top 20 Trading Rules

1. Always Use a Stop Loss

If you’ve ever read any of my other posts, this one certainly goes without saying. Without a doubt this one is mandatory for success as any kind of trader, whether the forex market or any other instrument.

Trading without a stop loss in place is pretty much like driving a car with no brakes. Don’t ever trade without one.

2. DON’T Overtrade

Again, you’ve heard me harp on about the dangers of overtrading.

But, to reiterate… when it comes to trading, less is more. By becoming more patient and critical of only trading the best setups, you will trade less, yet surprisingly boost your profits. Learn to focus on only the highest quality setups and don’t settle for less.

3. DON’T Fight the Trend

Another one that seems self-explanatory, yet it’s important for a couple of reasons. First, only trade markets that are moving actively. If it’s not trending or you’re unclear about the trend direction, you’ll likely get whipped out of trades. Just stay away.

Unless you have a well and truly proven edge in counter-trend trading… just don’t do it. While it’s tempting to pick tops and bottoms, you’re really just trading against the odds, and this game is hard enough as it is. As they saying goes, those who pick bottoms get stinky fingers.

4. If in Doubt, Get Out

When you’re every unsure of a trade, then simply don’t take it. After all, if you’re in doubt then the setup isn’t part of your trading plan. And there’s nothing worse than not having a plan for a present situation.

5. Only Trade Active Instruments

Often overlooked but non-the-less important, traders can’t make money unless the market is moving.

It shouldn’t come as much surprise that big profits are made in trending markets, not only because of your initial position, but also because you can then pyramid into trends, multiplying profit potential significantly.

6. DON’T Exit A Trade Unless You Have A Good Reason To

Most of us at some point have closed a profitable trade because of the fear of giving back unrealised profits. And most of us have then seen the trade then continue in the intended direction soon after.

This is one of the most important things to master. To be a successful trader, you need to control your emotions and allow yourself to trade in a manner that is purely technically based.

7. DON’T Average Down

This one has existed as long as trading, itself. Never, ever, ever add to a losing position.

Why? Simply because if your trade is losing, then your analysis was incorrect. Simple. By adding to a losing position you’re increasing your risk without having any favourable reason to.

8. Never Get In or Out of the Market Because You’re Anxious or Impatient

As much as patience is about waiting for the correct trade setup, it’s equally as important when managing open trades.

The market basically does whatever it wants. That’s why we, unless trading options, don’t set time limits on our trades, but simple stop losses and targets. Then we monitor both to see if the market has a change of character and act accordingly.

9. Steer Clear of Small Profits and Large Losses

The key to longevity in Forex trading is to keep losses small. So much hard work can be undone by be careless with your stop loss. By aiming for at least a 2R on each trade setup, you can afford to be wrong the majority of the time and still maintain a profitable trading account.

The second component is of course letting your winners run. The market can cover incredible distances over time, so when the opportunity presents itself it’s a great idea to pay attention and heed what the market is telling you.

10. DON’T Cancel or Move your Stop Loss After You’ve Placed A Trade

This is important for one simple reason – your emotions and judgement can easily become skewed once you’re in an active trade.

By determining your risk and SL prior to entering a trade, you’re doing so from a purely unbiased point of view. This also helps strengthen your trading discipline by doing what the market says instead of what you want.

11. Avoid Jumping In and Out of the Market Too Often

If you find yourself getting into a position only to jump out shortly after because you ‘see a better setup’, then chances are you’re risking too much capital on a single position. You’re likely trading with the mentality that you can find a better setup that will make you more money in a shorter time, and this is a fundamental flaw.

Wrapping up

You know, it’s quite amazing that in the 100 or so years at least since Gann came up with these rules just how applicable they are in today’s market. This should prove that some of the most simplistic psychological trading lessons are here to stay.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account