The Trick to Determining Trend Strength

It’s safe to say that every trader should aspire to know not only how to identify a trend, but also determine the strength of a given trend. After all, it’s the strength of a trend that allows us to trade with momentum on our side, putting the odds on our side.

So how exactly do you gauge the strength of a trend? I’m sure many of you have tried a variety of indicators that claim to do the job for you, but why make a relatively simple task more complicated?

First, let’s take a look at the characteristics of a trending market. So many new traders implicate the concept of a Forex market trend, but I assure you all it’s really quite simple.

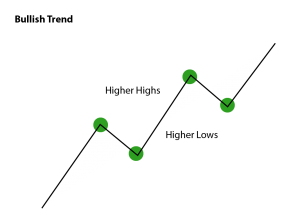

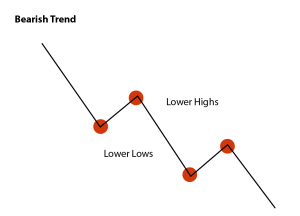

What we want to see is nothing more than a market making higher highs followed by higher lows for a bullish trend, or lower lows followed by lower highs for a bearish trend.

Simple, right? Let me show you what it looks like.

Easier than you thought, isn’t it? Now, what can we do with this info.

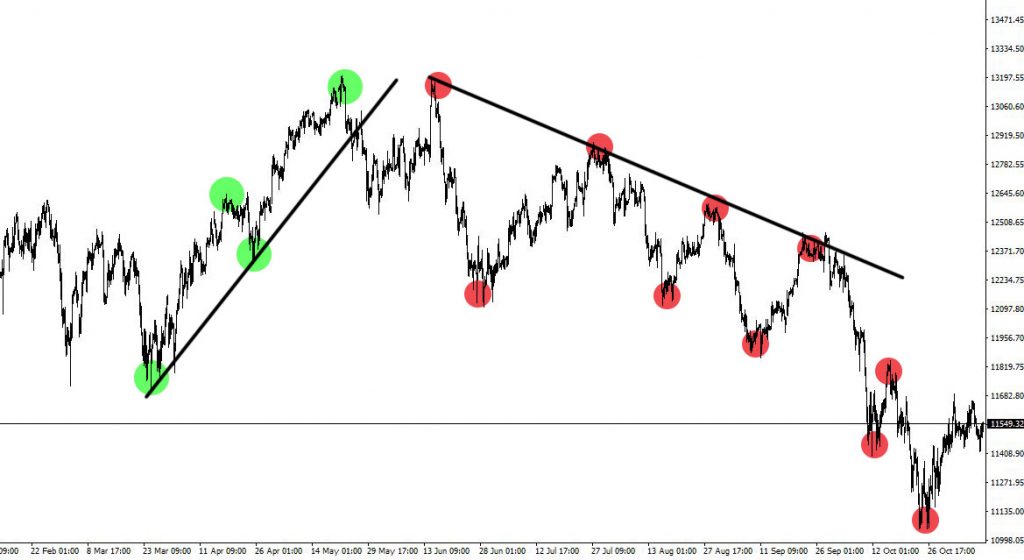

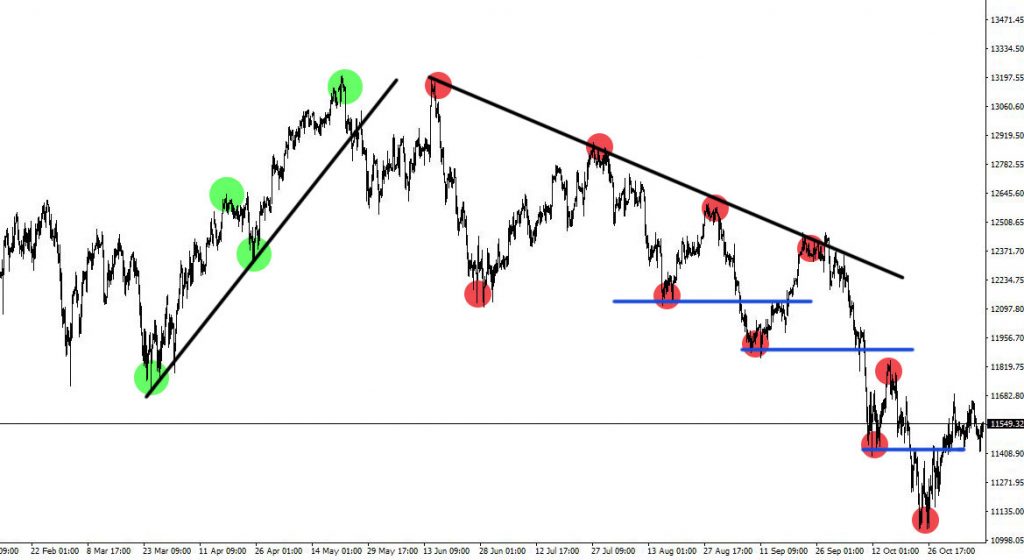

To do this we’ll take a look at an actual chart and take note of the swing highs and lows within a given trend.

You can clearly see that over the period of time there are easily identifiable trending periods demonstrated by the swing highs and lows.

But how do we know how strong the trend actually is? To help us with the strength of an underlying trend we need to take into consideration some key levels. Notice the trendlines and how one is respected by price better than the other? The first bullish trendline was broken to the downside after just two swings, which indicates that the trend was struggling to maintain its bullish momentum. This was then confirmed by the double top (first red dot), where price failed to make new higher highs.

Now the second trendline shows that price is being consistently rejected by these levels, pushing price further down with increasingly stronger swings on the downside, while consistently weaker upward swings are showing us that the bulls really don’t have much strength and upward momentum can’t be sustained.

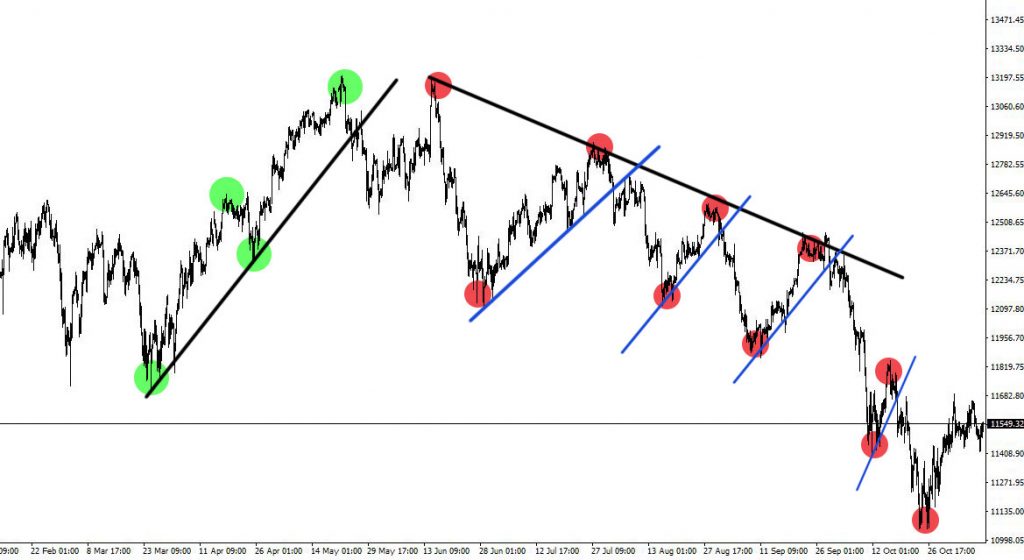

You will also notice in the image below that after price rejected our bearish trendline, a trader could’ve shorted the market once price broke below our swing trendlines, shown in blue. These trades present us with low risk – high reward entries.

Alternatively, traders could short once price breaches the previous swing low as shown below.

Wrapping up

One of the easiest ways to determine the strength of momentum in an underlying trend is to simply see how price respects horizontal and diagonal levels during its swing highs and lows. Just like everything in trading, it’s not an exact science, but it is a very easily identifiable method that can be utilised to trade with the trend, and capture quite a significant portion of the prevailing trend.

The best thing that any trader can do to determine the strength of a trend is to just go back to basics and identify key levels through swing highs and lows.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account