The Magic of the Measured Move for Profit Targets

Sometimes, one of the most challenging aspects of trading the Forex market is determining a suitable and realistic take profit area. In fact, I’d argue quite strongly that determining an exit (whether in profit or at a loss) is significantly more difficult than developing your trade entry strategy.

With that said, your take profit strategy doesn’t have to be difficult, which is why today we’re going to discuss the ‘measured move’ method of determining appropriate profit targets for price action trading patterns.

To give you an idea of how to determine the measured move target area, we’re going to use a couple of popular price action patterns, the Head and Shoulders, Channel and Wedge.

So, what exactly is a measured move?

Each price action pattern offers us critical information in determining the behaviour of any trading instrument.

Not only does each pattern offer insight into a possible directional move, but they also give us an edge in determining the extent of where the market might move as a result of a given chart pattern. This, is what we refer to as a ‘measured move’. Simply put, it’s the distance measured from the break out point to the pre-determined target level.

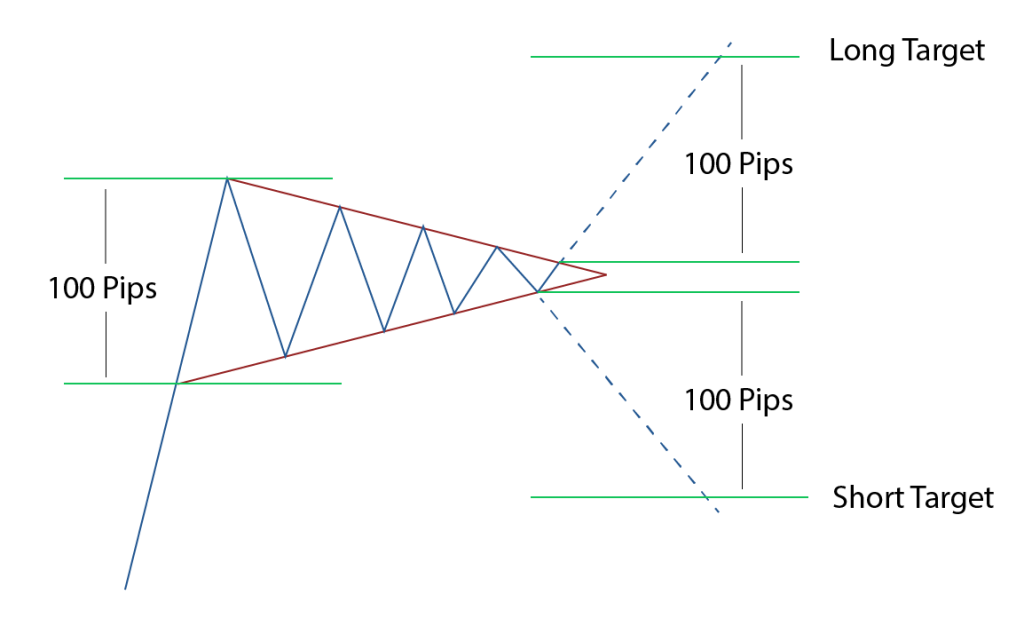

You’ll notice in the wedge example above that a measured move is simply the same distance of the first swing that formed the pattern to begin with. Thus, making our profit target 100 pips… should price break out and confirm our pattern.

Let’s have a look at a couple of others.

Head & Shoulders Pattern

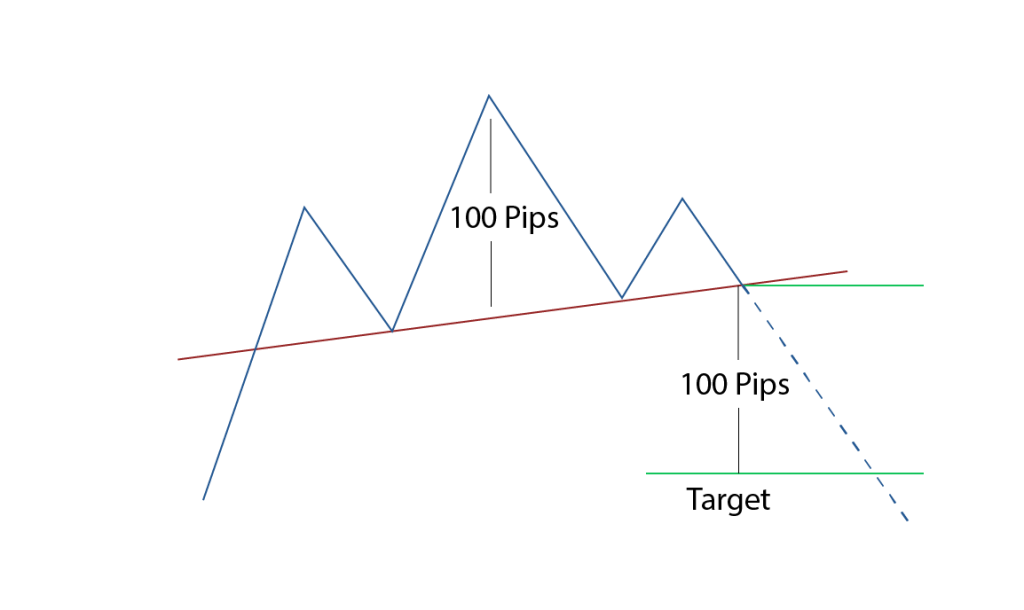

Ok, so let’s check out the H&S reversal pattern, and its measured move target levels.

In order to determine the measured move target for Head & Shoulders patterns we take the distance in pips from the top of the head to the neckline directly below (or inverse for Inverse H&S patterns), and apply that distance from to the breakout level.

Now, whilst the neckline of H&S is seldom perfectly horizontal, this doesn’t affect our target area, as there is still a clearly defined measured move in play once price breaks through the neckline.

Consider the illustration below.

Channel Patterns

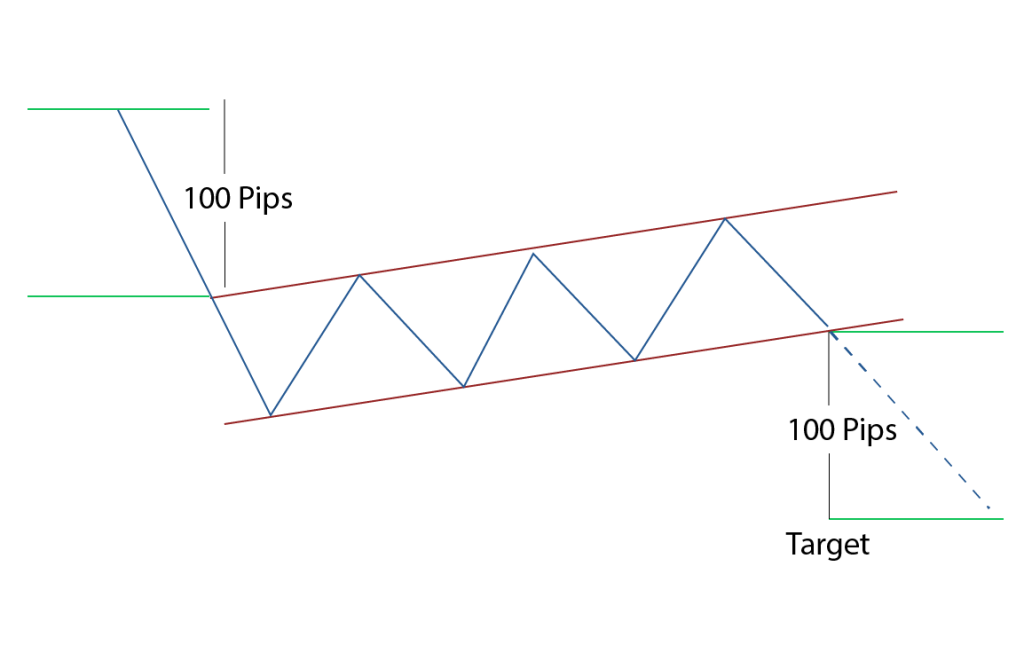

Now, let’s take a look at channels, be they continuation or reversal patterns.

These channels are a great pattern to trade, because they occur regularly and their measured move target area is more often accurate, than not.

Here’s how the measured move is calculated.

The thing about determining a measured move target level for channels, is that in this particular instance (a flag), we use the entire up or down move that led into the channel pattern to come up with our measured move level.

But wait, there are some caveats

While the measured move targets we’ve just discuss

So, if the measured move target is 100 pips away but there’s key support or resistance 75 pips away, it’s a good idea to watch these levels quite carefully, because as you know too well that because they’re tried and tested areas, they’ll certainly influence price. Why try and squeeze an extra 25 pips when the support and resistance is clearly more influential than a measured move target.

And, like everything in Forex trading, there are no guarantees and there are no strategies that are without their flaws. This is no exception.

Despite measured moves being typically useful and quite often met by price, there will always be times when it just doesn’t work out. Think of them as a guide for how far price COULD move as opposed to determining how far the market WILL move.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account