Identifying the Forex Flag Pattern

We’ve touched on flag patterns before in our ‘flags and pennants’ post, but let’s go into a little more detail. After all, flag patterns come in all sorts of shapes and sizes, and it’s not as simple as calling a flag a flag, so to speak.

Typically, flag patterns indicate a continuation of the existing trend. So, if a currency pair in the forex market is showing a bullish trend and then forms a flag, there’s a pretty decent chance that the break will be to the upside. And of course, the opposite applies in a downtrending market.

But here’s a key element that can often go overlooked. See, a flag is only a reliable continuation pattern if the flag itself forms at an angle that’s opposite to the existing trend. Ie, the flag will slope downwards in an uptrending market, and vice-versa for downtrending markets. If this opposing slope isn’t there, neither is the pattern.

So what does this mean?

Well, to put it bluntly, it means that if you’re not being critical of this one key component, then you’re pulling the plug on your profit potential because you’re simply going to be stuck on the wrong side of the trade.

Let’s sus out the flag pattern in more detail.

The Continuation Flag

Before diving deeper into the significance of sloping flags, it’s important to get your head around why a flag pattern forms.

As I mentioned before, flags are most often a continuation pattern. The most profitable of these flag patterns form within an existing, strongly trending market and are a result of profit taking, causing a slight pullback and offering us a chance to get enter into the overriding trend.

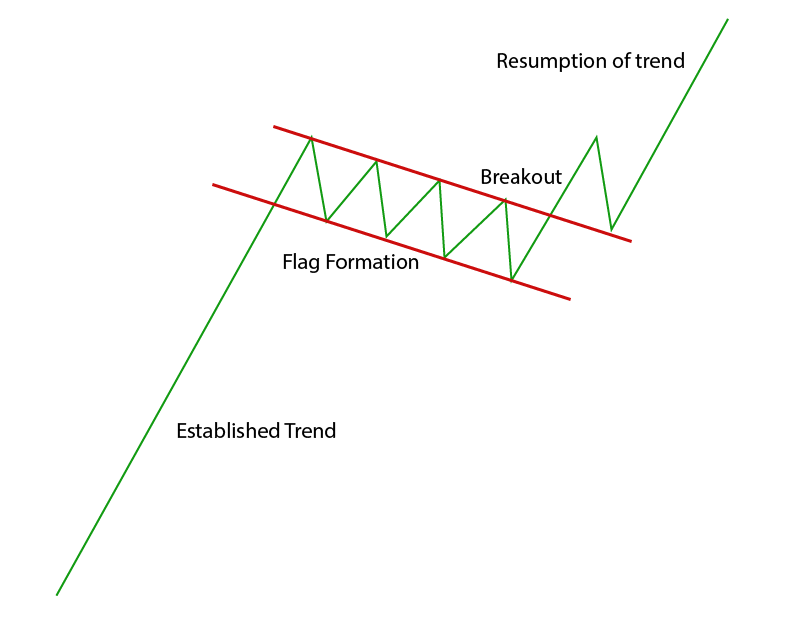

Check out the bull flag below.

Notice with the illustration of the flag pattern above that the flag forms after an extended bullish move. Then, buyers take some profit causing a light pullback at an angle opposing the trend direction, before breaking out and resuming its upward trend.

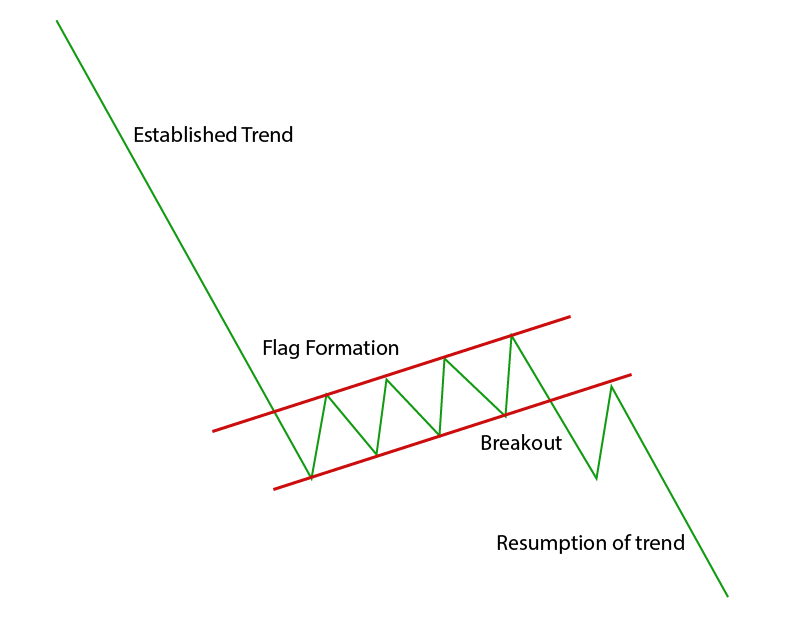

As you might have guessed, this is what the bear flag tends to look like.

Why Do Flags Form?

First and foremost, these patterns are an indication of price consolidation. As I’m sure you’re aware, a healthy trending market pauses time to time to distribute old holders and accumulate new buyers or sellers.

Quite simply this scenario represents the same cycle of buying and selling that happens throughout the duration of a trending market. Throughout times of consolidation, we’re simply seeing money changing hands between buyers and sellers.

As price action traders, we need to be on the lookout for favourable trading patterns such as flags. This allows us to catch the trend as it continues, while offering an extremely favourable R-ratio.

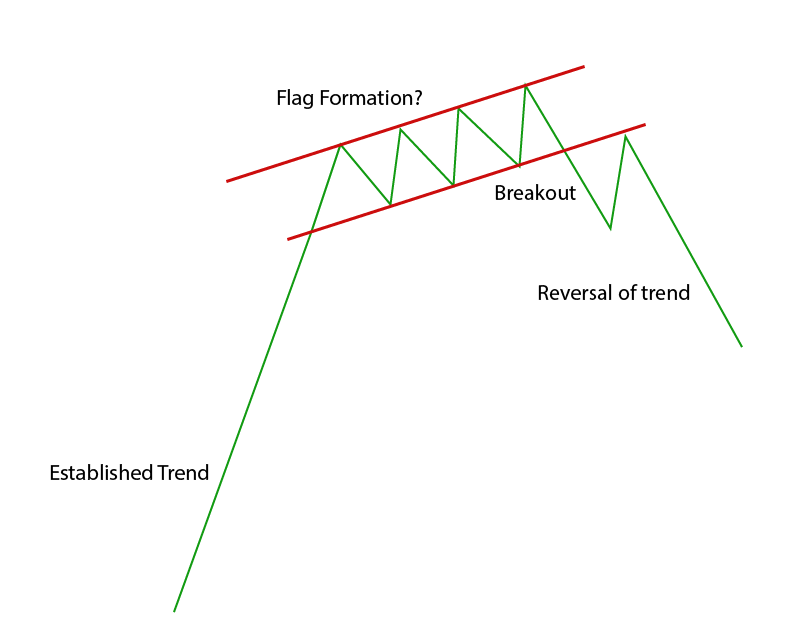

The Flag That’s Not a Flag

There are some common misunderstandings of what constitutes a continuation flag pattern and what doesn’t.

The only difference between these often misunderstood patterns is the angle at which the flag develops. Everything else looks the same, although the difference is critical.

You’ll notice how the misunderstood ‘bull flag’ pattern formed in the direction of the trend, not against it. Although a minor difference, the significance is strong. See, these ‘flags’ are inconsistent in their outcome, though can quite often represent exhaustion of an existing trend.

In order for this pattern to be considered bullish, we need the consolidation to slope AGAINST the momentum.

Wrapping up

Bull and bear flags come in all sorts of sizes and shapes, but the one thing that never changes is that the angle of the flag has to oppose the current trend in order to be considered tradable. As forex traders, it’s not our job to take every single trade setup, it’s our job to take the trades that put the strongest odds in our favour. We do this by being very selective and choosing only the highest probability setups to trade.

Keep this close to mind and more often than not you’ll hit the resumption of the trend by trading these quality flag patterns.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account