How to Trade Channels Like a Champ

Parallel or equidistant channels are a popular favourite among technical Forex traders. A channel formation is constructed of two parallel lines indicative of support and resistance and can be either bearish or bullish depending on the overall direction of price.

Today we’re going to take an in-depth look at both ascending and descending channels and check out things like how to identify them, and the best way to trade them.

What exactly is a price channel?

Before we can even discuss how to trade channel patterns, let’s go over a few of the characteristics that make it what it is.

A price channel is formed when price finds both support and resistance between two parallel trend lines, or a channel.

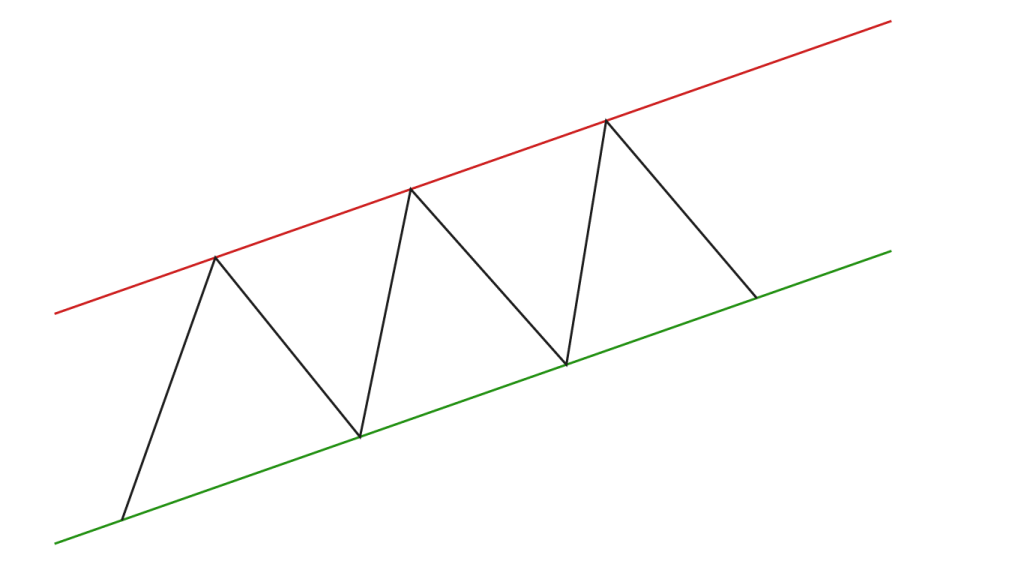

Consider the example below:

You can see quite clearly that the channel is ascending as price is making higher highs and higher lows.

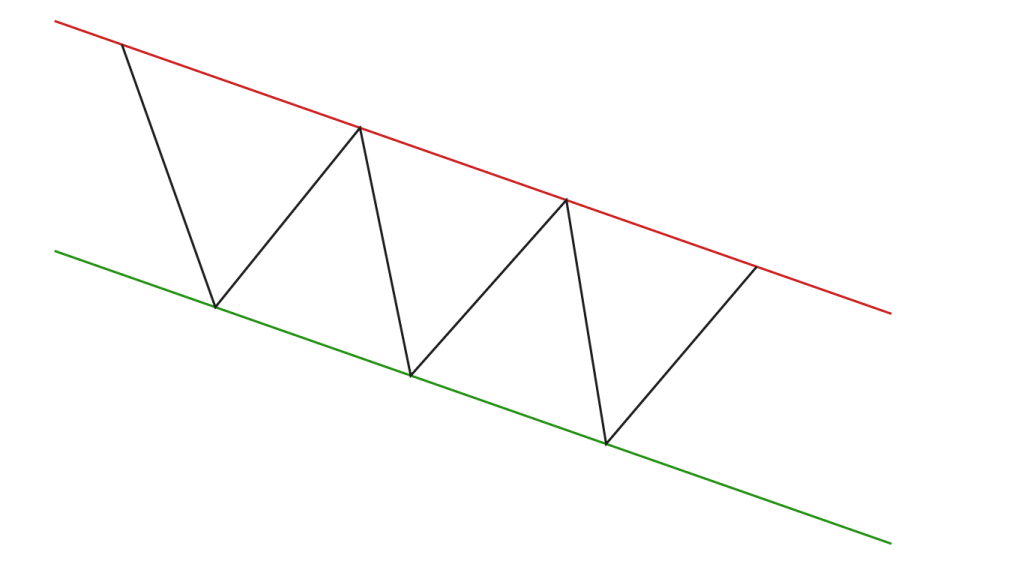

The inverse is true for descending price channels.

How to identify price channels

Price channels are relatively simple to identify once you know what you’re looking for. The easiest way is to simply draw a clean trendline and then check out whether a parallel trendline is being respected by price. If you know how to draw a trendline, you can draw a channel.

Trading Price Channels

One of the first things to learn when looking for setups within a price channel as that the trend is your friend, and as such you should always try and trade in its direction.

Below is a textbook example of a long trade within a price channel taking place on a daily chart of AUDNZD on the Forex market.

Notice how in the above example, price forms an engulfing pattern after a couple of rejections from the bottom of our upward trending price channel, representing a valid buy setup.

As this is a live chart we won’t get to see how it plays out just yet, however if one were to take this setup there are two logical profit areas that we could target: The previous high or the top of our channel.

Our stop would be placed underneath the low of our engulfing candle, which is also just outside of our price channel.

As you can see, the risk:reward ratio for this setup is very attractive, risking approximately 100pips in order to make 300pips+, or 3R+.

One of the advantages of price channels is that they allow a trader to form a directional bias based on whether the channel is ascending or descending.

Well, that was short and sweet.

One of the things I love about price channels is their simplicity. There are more in-depth ways to trade channels but the setup I’ve outlined is one that every trader should keep up their sleeve.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account