Carry Trading and the Forex Market

The majors of the Forex Market

The forex market, unlike the stock market which has thousands of stocks from which to choose has only a handful of economies to follow in order to determine the best trade opportunities. The forex market majors are:

USA

Europe (Germany, France, Italy, etc)

Japan

UK

Switzerland

Canada

Australia

New Zealand

The above economies have the largest financial markets across the globe. By focussing your attention on these countries, you’ll find it easier to take advantage of the most credible and liquid instruments within the forex market.

With news events released almost on a daily basis that effects most of the above countries, investors are able to frequently stay abreast of the health of each economy.

Yield and return

When trading currencies, the key to remember is that yield means returns.

When trading the foreign exchange market, a trader is buying and selling two currencies. Because all currencies are valued relative to one another, they’re all quoted in pairs. Such as EURUSD at $1.2200. This means that it costs $1.22 to purchase one euro.

As alluded to, in every Forex transaction, you’re both buying one currency and selling another simultaneously. Every currency you trade also comes with an interest rate that’s determined by each country’s central bank. If you sell a currency, you’re required to pay this interest, however If you buy a currency then you’ll receive interest on the currency that you’ve purchased. It’s important to remember, that although you can earn attractive interest rates with some currencies, the value of your trade can still decrease due to the price fluctuations of any particular currency pair.

Another instrumental tool in achieving yield/returns with Forex, is leverage. This means that you can effectively trade a larger amount than your capital would otherwise allow. Whilst this can help achieve great returns, it can also amplify any losses.

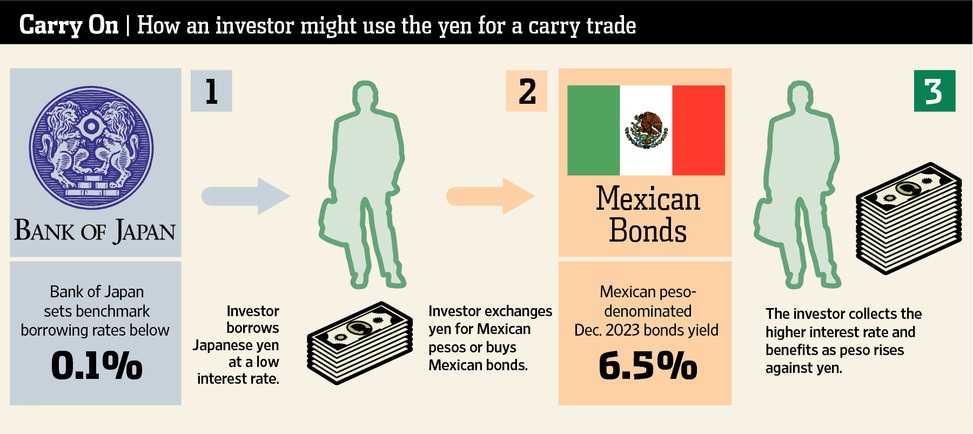

Carry Trades

The value of a currency never remains still, it’s constantly in a state of movement. This is what led to the conception of Carry trading. Carry traders trade with the intention to earn interest as well as looking for the currency position to appreciate in value through being on the right side of a trending market.

Over an extended period of time, carry trading can lead to a significant yield when markets are trending longer-term. This unlocks the huge potential to earn not only interest yields of 3-5% but also the profit from your buy and sell point in an uptrending market.

When creating a profitable carry trade strategy, it’s not quite as simple as just choosing pairing up the currency with the highest interest rate against the currency with the lowest interest rate. Instead, the direction of the interest is what’s important. You need to be long in a currency with an expanding interest rate and against a currency with a stagnant or contracting interest rate.

Again, it’s important to reiterate that you want to choose carry trades that not only have a growing positive yield, but pairs that also have the potential to appreciate in value over the longer term. This is vital because just as a currencies appreciation can increase the value of your trade profits, depreciation can very quickly erode your capital.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account