Overnight Headlines

*USD is muted with narrow ranges over the past few sessions

*US equities reached record highs on the bipartisan infrastructure deal

*Oil climbs to the highest level since October 2018

USD has been quiet overnight trading just below 92 on the DXY. Buyers have been active around the 200-day SMA with two bullish hammer candles printing recently, though the greenback closed lower on the week. Commodity sensitive currencies also gained with this week’s focus on Thursday’s OPEC+ meeting and US data in the form of the ISM and NFP reports.

US equities moved further into record territory on Friday enjoying their strongest weekly performance since February. President Biden’s infrastructure deal outweighed concern over the highest US inflation reading in 29 years. Asian shares have got off to a cautious start with Australia recovering early losses after Sydney got put into another lockdown after Delta infections surged. Futures are marginally higher.

Market Thoughts – Mix of risk events this week

There are a number of different risk events ahead this week, with eurozone inflation catching the eye on Wednesday. Analysts forecast a reading of 1.8% from the 2.0% May print with positive base effects from energy costs behind the recent rise in prices. Recent PMI surveys point to stronger inflationary pressures going forward, though the ECB, like their US peers, say this will be “transient”. If we do see the start of higher wage prices, then this may change central banks views and force them to get more hawkish.

The OPEC+ meeting on Thursday sees growing expectations for the group to increase supply after the near 50% surge higher in crude prices this year. OPEC+ still has nearly 6 billion barrels per day to bring back to the market with at least 500 million barrels per day needed to increase supply in August. Anything less could well see bulls push the market higher in the near term.

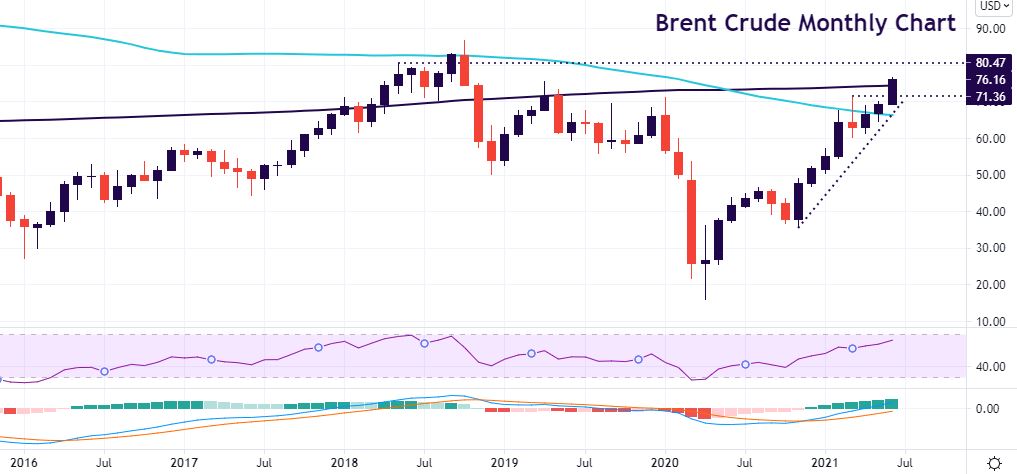

Chart of the Day – Strong Oil on demand optimism

OPEC+ are set to agree production levels for August and beyond after we’ve seen strong investor rotation this past month into oil and other energy commodities and away from metals and agriculture.

We can see on the monthly chart a near 10% rise in prices in June. We pushed decisively higher through the 100-month SMA last month and we’ve just broken above the 200-month SMA. Targets to the upside include the May 2018 high at $80.47 where we saw some resistance through the summer of that year. Support lies at this March’s high at $71.36 and the January 2020 high at $71.28.

Jamie DuttaAnalyst / Trader

"With extensive experience as a full time trader and financial market commentator, I have worked as a trader in top tier investment banks and trading houses, including Morgan Stanley and GAIN Capital trading Forex, Index derivatives. and Bonds. I combine technical analysis with a deep fundamental knowledge to identify trade set-ups. My real life experience allows me to break down the complexities of financial jargon and trading. This means everyone can better understand the compelling forces of greed and fear which are realised every day in countless ways across markets."

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account