How to Win Big in a Trending Market

If you’ve never heard of pyramid strategies in relation to Forex trading, you could be missing out on huge improvements in your profits.

However, as profitable as pyramid strategies can be, they can also be a bit of a double-edged sword if implemented incorrectly. That’s why we’re going to chat through them today so you can see exactly how they can be used to boost your bottom line.

So, what’s Pyramid Trading?

Pyramid trading is a relatively simple concept that is about scaling in to your winning positions. Basically, you strategically place additional buy or sell orders, adding to your existing position when the market offers another signal in your current trade’s direction.

The thing with pyramid strategies is that when you nail it, boy oh boy you nail it. But when you’re wrong, you need to make sure that you’re only a little bit wrong.

Pyramid strategies fit perfectly into a sound methodology, because you’re compounding winning trades, while at the same time reducing your overall exposure in a given trade.

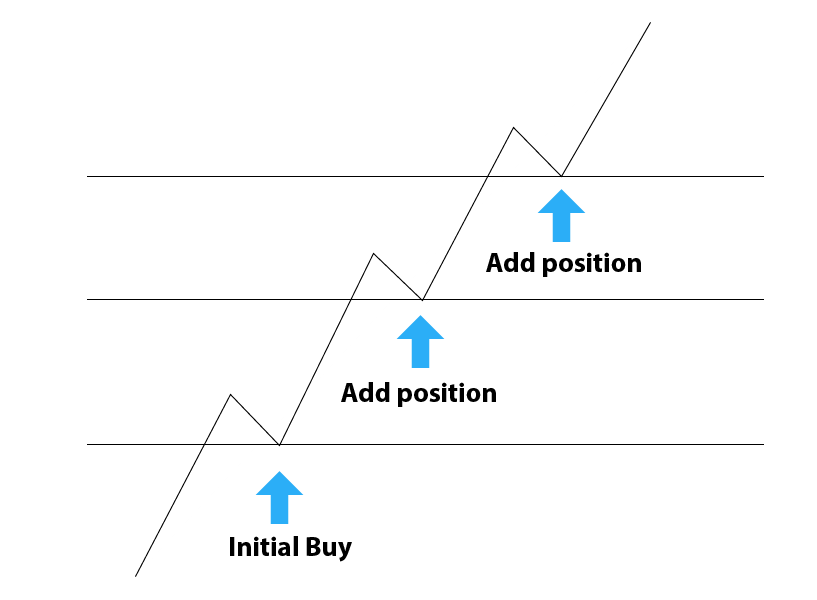

The theory of pyramiding positions works as follows:

As you can see from the diagram above, the market is making a series of higher highs and higher lows, so we’re in an uptrend in this example. Of course, it doesn’t always look as perfect as this, but the principle remains the same. As soon as resistance is broken and becomes support, we’re offered a low-risk opportunity to add to our trading position.

How to Maximise Profit by Pyramiding

As I’ve tried to hammer home several times, the key to successful trading is to maintain a decent risk/reward ratio. Of course, you’ll note several times I’ve mentioned that you should aim for at least a 2R multiple.

All of this however, is contingent on their being a strong trending market. Though you will notice that on occasion these runs will continue well into your favour offering upwards 10R throughout solid trending periods.

The long and short of Pyramid strategies

There’s absolutely no doubt that pyramid trading can be extremely profitable when implemented correctly. However, it’s not something that should be used excessively. Instead, try to be selective and wait until there are very clear demonstrations of strength and momentum, for example, through a series of higher highs and higher lows.

It’s important to not be greedy, because as you know well, the Forex market ebbs and flows, and even the strongest of trends eventually will end. That’s why it’s important to define your exit strategy well before even placing the first trade.

Defining your exit strategy in advance allows you plan while you’re in a neutral state of mind. Failure to do this results in you planning your exit whilst in a trade and it becomes highly likely that your emotions will influence the decisions you make.

Even if you manage to catch a couple of pyramid trades per year, you’re looking at a monster profit from just a handful of trades. Coupled with the fact that your risk is very minimal for each trade, pyramid strategies can be extremely favourable when used at opportune moments.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account