How to choose a stop loss strategy that works for you

Ok, so you’ve got your entry strategy down pat, what’s next? If you haven’t already, now you need to have a think about what stop loss strategy you’re going to implement.

Today, we’re going to go over a few different stop loss strategies that can help you to minimise your risk and maximise your gains in the Forex market.

Let’s get started

For the sake of this article, we’re going to be using our pinbar strategy from here, so if you’re not familiar with it, jump over and give it a read and then come back.

Placing your initial stop

Where you place your initial stop loss depends greatly on your trading strategy. While there is personal preference that might influence where you place your stop, but let’s go over a few common places to set a stop with reference to the pinbar strategy.

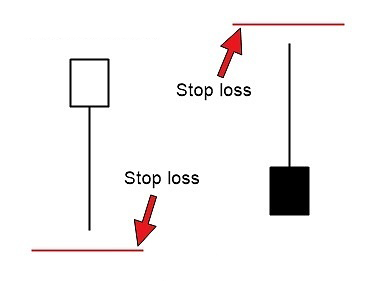

As you can see for the pinbar strategy, the stop loss is typically placed just beyond the tail of the bar, regardless of whether it’s bullish or bearish.

Why there? Well, simply put, if price hits this stop loss then your pinbar setup is invalidated. A lot of people view price hitting their stops as a bad thing, when it’s more the opposite. One, you’ve just been saved from potentially greater drawdown, and also, the market is telling you that the setup wasn’t quite strong enough.

The ‘set and forget’ stop loss method

As the name suggests, this strategy is about as ‘hands off’ as it gets. You simply just place your stop loss and let the market run its course… just make sure you don’t interfere with your stop loss while in the trade.

Pros

-Reduces emotional trading

-Easy to implement

-Gives the trade enough room, avoiding early stop outs.

Ok, so let’s go through those points in a little more detail. First, this helps to remove emotion from your trades because there’s no need to interfere or interact with it once you’re in the trade. You simply sit back and let the market do its thing.

Also, by giving the trade enough room to breathe with a suitable stop loss distance, we reduce the likelihood of being stopped out too early in the trade, only to see it continue in our intended direction.

Finally, it’s simple… you set it once and then never have to touch it again.

All this sounds great, however, it’s not without its disadvantages.

Cons

-The largest allowable risk for the duration of your trade

-Temptation to move stops closer to entry points

So, first of all we’re keeping our maximum allowable risk open from the start through to finish of the trade. That means no stops to breakeven, etc and there’s no additional protection to your capital than this initial stop loss. This can be a costly disadvantage.

And temptation, while this can manifest itself at every stage of a trade, if you give in you risk being stopped out of your trade prematurely, which is not only costly, but extremely frustrating.

Moving stops to breakeven

It’s hard to cover stop losses without at least touching on ever-so-controversial, break even stop loss.

First and foremost I have mixed feelings about this, simply because if I move my stop to break even and price takes me out of the trade, the market HAS STILL YET TO PROVE ME WRONG. Price has simply moved back to my entry area and not invalidated the setup.

However, I will say that I’m quite partial to locking in some gains by taking half a position off the table as an alternative way of managing risk.

See, most traders will justify moving a stop to break even by saying “But, but, it protects my capital.” There’s an element of truth to this, but all it really does is protect their feelings because they feel safe if they know they’re not risking any capital.

Again, let’s go through the pros and cons.

Pros

-Eliminates risk on a trade

-‘Peace of mind’

Cons

-It severely hinders your odds

-It’s incredibly lazy

-It demonstrates an emotional flaw

-It uses an arbitrary level that’s not very well thought out

It’s probably quite easy to tell that I’m not a fan of breakeven stops when it comes to Forex trading. It’s just lazy. There’s no analysis required, you’re just trading from a fearful place. Breakeven is an important level for you, not the market. It’s completely insignificant in the context of the market and the only thing it protects is your ego… until it gets hit over and over again and you get knocked out of a trade that would’ve been in profit had you given it room to breathe.

Trailing Stops

Right on! Ok, now let’s evolve our thinking a little. When the market starts to move in your intended direction during a trade, this is where a trailing stop can come in quite handy.

Now, there are two general methods of trailing a stop loss; manually, or automatically. Automated stops at their most basic level, simply trail price by a number of pips defined by the trader. I’m not much of a fan of these either because they’re again arbitrary by nature, with no real rhyme or reason as to why the trade should be closed.

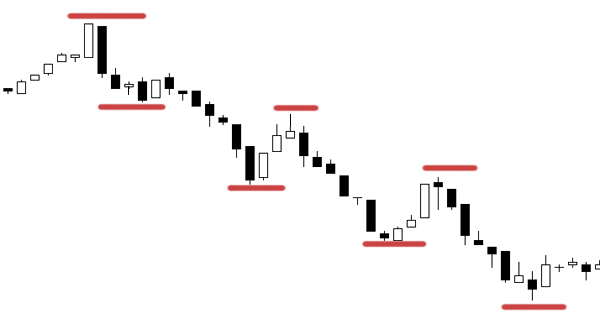

Here’s where it gets good. Let’s chat a bit about manual trailing stops. Now, of course you can place these arbitrarily, but let’s assume that we’re all a tiny bit more intelligent than that. With manual trailing stops, we’re now using price action to determine where our stop loss should be placed if price advances in our favour. Now, you could move your stop in accordance with key levels being taken out, or candle patterns, whereby you’d move your stop to a point in which the pattern or level is invalidated. I personally look for violations to when trailing my stop loss. For example, say I took a long trade and it moved in my favour, forming a few higher highs along the way. I’d look for something like the break of an upward trendline, or a failure to make higher swing highs as an indication that the move has run out of steam.

Obviously this requires a little more work than the arbitrary methods, however you’ll find that you can capture much larger moves when you trade according to what’s happening right in front of you on the charts.

Let’s wrap it up.

Again, like so many facets of the Forex market, there’s no one way to do things. Everyone needs to evolve their methods into a manner that suits them better. While it sounds complicated, I’d suggest for everyone to experiment with manual trailing stops because there is true value in letting the trade play out until it’s got no more steam left in the engine, it just takes a bit of time to learn.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account