Sharpe Ratio and Forex Trading

Sharpe Ratio

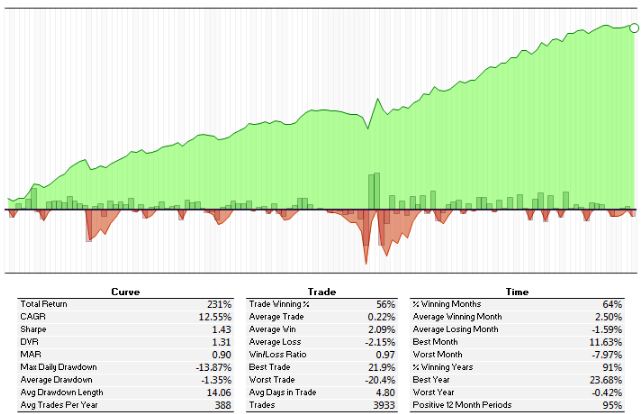

When we talk about Sharp Ratio in the forex market, what we’re talking about is the measure of risk-adjusted return in a trade/s.

It came to front thanks to Prof. William Sharpe, a recipient of the Nobel Prize in Economics.

The calculation for the Sharpe Ratio is quite simple. You put some money into a forex trade, then you calculate the value of your trading account (including the initial investment plus the profit/loss) over a given period, say a month, every month. From this we can calculate the percentage return of each month. Now, what the investment is doesn’t really matter. You can be trading 100+ systems each month or just one, it doesn’t matter. All that matters is the value of your trading account at the end of each month.

From here we then calculate the average monthly return over a number of months, let’s say 12 months. By averaging these returns for 12 month you can also calculate the standard deviation of the monthly returns over the same period.

Next, we can annualise the numbers by multiplying the average monthly return by 12. Then, we multiply the standard deviation of the monthly returns by the square root of 12.

Next, we need a number for the “risk-free return” which is the annualised return currently available on “risk free” investments. More often than not this is assumed to be the return of the 90-day T-Note which is (give or take) 5% per annum.

Now we can calculate the “Excess return” which is the annualised return achieved by your investment in excess of the risk-free rate of return available. This is the return you receive by taking on some risk. (As measured by the standard deviation of the returns).

Excess return = Annualised return – risk-free return

Now for the Sharpe Ratio.

Sharpe = excess return / annualised standard deviation of returns/

This will give you the Sharpe Ratio of returns over the past 12 months.

This is assuming you’re not trading or investing using margin.

So, what can this tell us?

The Sharpe Ratio, which is a reward to risk ratio, is independent of the leverage we use so long as the standard deviation is small. Increasing the leverage increases the risk and reward proportionally, but as the standard deviation gets larger, the benefit of leverage starts decreasing. In fact, at some point, increasing the leverage further decreases the return because the amount lost in bad months (or days, or x-period) is not made up for in good periods.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account