The Forex Trader’s Risk Management Checklist

Are you struggling to turn a profit trading the Forex market? If that’s you, then it’s time to take a step back and start working on your risk management strategy.

Risk management can be simply explained as capital preservation. Meaning, traders mitigate their exposure to market moves, something that the pros are extremely disciplined at.

So how can you up your risk management game? Checkout this checklist to find out.

- Are you genuinely ready to trade?

This sounds like a dumb question, but time after time, new traders get carried away with the enthusiasm of trading. That only ends up with traders taking trades based on the hope of making a quick buck. There’s nothing wrong with eagerness, but it can often result in hefty loss.

Is there a solution? You bet! Create a list of specific criteria that warrants a trade entry, and DON’T place a trade until you’ve ticked every box. If you’re stuck where to start, define your SL first.

- Do you understand Risk Management?

If you feel ready to trade, you need to understand the significance of risk management. As a trader, it’s your job to not only grow capital, but to do everything you can to protect and preserve it, too.

So what’s the key? Consistent profits should be your trading goal. Many people try to take too large a position in a trade, and whilst they might get lucky a few times, sooner or later the market will prove you wrong and give you a wakeup call in the form of a huge smack to you capital. So, before you place your next trade, ensure your position is sized correctly with risk in mind.

- Is your mindset correct?

This might sound a bit too ‘spiritual’ to some, but your state of mind is of the utmost importance as a trader. Before you place a trade, think for a second about how you’re feeling. If you’re emotions are a bit skewiff, then just sit it out for a little bit. There’s always other opportunities ahead, and missing one isn’t the end of the world.

All too often, traders forego their physical and mental wellbeing. As with anything, both of these are required to do any task well. Exercise, diet and mindfulness WILL make a huge difference to your trading performance.

- Can you afford to lose?

Before you take any trade whatsoever, ask yourself if the amount you’re risking is an amount that you’re willing to lose. If so, great. If not, then you’re on a guaranteed path to failure and a tonne of stress.

If you don’t have the funds to trade at any given time, build a pot. Add a small amount to it every month and while that pot is accumulating your trading capital, practice, practice, practice. I can’t reiterate this enough… PRACTICE! Hone your strategy so you know it instinctively.

How much money do you need to trade? Well, it depends on your desired instrument. For example, stocks require more money, whereas Forex can require less. With just a small amount of research you’ll be able to find a forex broker that suits the amount you’ve set aside to spend on trading.

- Have you got a clear reason for taking this trade?

We touched on this earlier in the article, and this is a rule that was crucial in improving the profitability of my trading. Never take a trade unless you can give a clear written reason (with confirmation) as to why you’re taking that trade.

For example, I’m a technical trader, so I have a select suite of setups that I use to trade. If the trade setup isn’t part of my trading plan, as much as I may want to take it for bias reasons, I can’t. If it’s not a valid, well-planned, proven trade setup, steer clear.

- Do you have a contradictory position already open?

Maybe this is a no brainer, but it applies specifically to the forex market; you trade a currency pair. That means it’s important to make sure that you don’t have conflicting open positions. An example would be if you’re long EURUSD and USDCHF at the same time. These positions essentially cancel each other out.

- Have you checked thought about correlation?

When trading forex, you’re betting on the value of one currency going up or down relative to another currency. This is called a correlation.

With this in mind, you should know that certain pairs move together, or inversely, and as such taking opposite trading positions on positively correlated pairs can result in unnecessary losses. Likewise for taking the same positions on negatively correlated pairs.

- Have you set your stop loss and profit area?

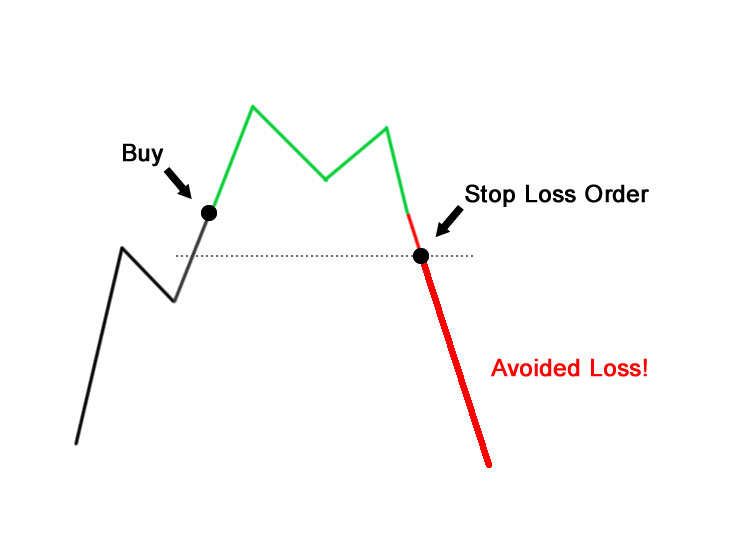

There are only a handful of trading elements that are within your control, the rest are purely up to the market. Perhaps the most important is your stop loss, or, the point in which the market has proved you wrong. More significantly, it’s the point at which your trade will automatically close.

The point in which you place your stop loss will vary according to your trading plan. Intra-day traders will likely utilise a tighter stop loss than say a longer term trader, who need to give their trade a little more room to breathe.

Setting a take profit, is somewhat more discretionary. Many traders use a fixed profit target, whether monetarily or a number of pips movement. Others let the trade run its course until the market gives them a signal. Regardless of your take profit method, it’s important to remember that to make money you need to take profit, so it’s worthwhile integrating a take profit strategy into your trading plan.

- Are you using a suitable amount of leverage?

Any of the best forex broker companies should offer leverage, which helps to amplify your profits or losses by allowing you to trade a larger amount of contracts than your balance would otherwise allow. Without a doubt, leverage increases your risk of losing a substantial amount of your trading capital so it must be used with caution.

- Are you willing to lose this trade?

Ask yourself the question “Can I accept a loss if this trade goes against me?”. If not, you shouldn’t be trading. It may sound harsh, but losses are an important part of every trader’s life. They happen, and they’re unavoidable so there’s no point in you fearing them.

The best thing you can do is accept that you lost, and then more importantly, study your losses. By reviewing every trade that goes against you, you’ll be able to identify certain mistakes that you’re making, or refinements to your strategy in order to further reduce losses that occur due to improvements that can be made only through experience.

There you have it folks, feel free to utilise any or all of the above tips or by all means, come up with your own. You’ll be surprised how much it helps to tick all the boxes prior to entering a trade.

Fast & easy account opening

-

Register

Choose an account type and submit your application

-

Fund

Fund your account using a wide range of funding methods.

-

Trade

Access 300+ CFD instruments across all asset classes on MT4 / MT5

That's it, it's that easy to open a Forex and CFD trading account.

Welcome to the world of trading!

open live account